NUGGETS OF ALPHA

China has the largest foreign exchange reserves in the world

China’s M2 money supply is exploding

Global liquidity has fallen due to the U.S. tampering with its money supply

Hong Kong seeks to become a new hub for digital assets

Due to its regulatory framework, Hong Kong has become a major hub for crypto trading in Asia

Hong Kong wants robust and Lindy-proven tokens with real-world use cases

Combined, Hong Kong and China control greater than 21% of the world’s wealth

Only 33.88% of Solana is held by the top 100 wallets

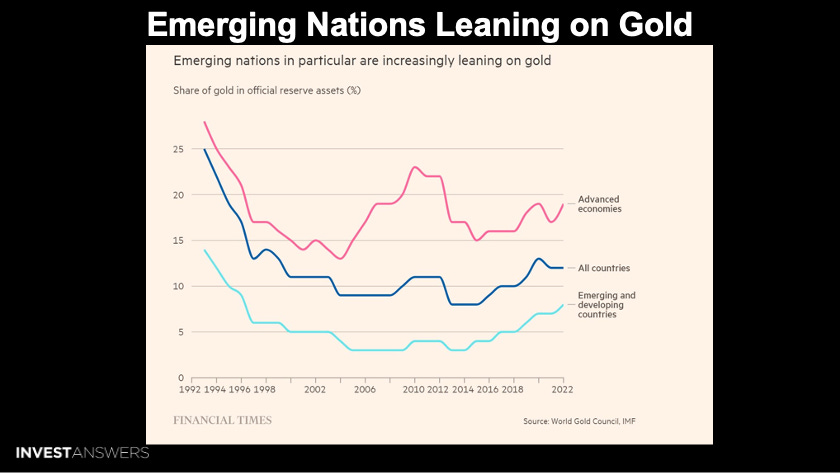

China has the largest foreign exchange reserves in the world and has been buying gold for six months. This is China’s plan to challenge the U.S. dollar.

Economies in distress are also turning to gold. Ghana and Zimbabwe are using gold to prop up their currencies.

Why do we care? Because Bitcoin is digital gold!

According to a Bank of America study, China has changed from the un-investable just a few months ago to being the most seemingly crowded trade in February 2023.

This is hard to believe, given out of all the funds I track, only two had new Chinese exposure.

China’s M2 money supply is exploding, and it is hard to understand exactly what China is doing related to monetary policy. However, they definitely need some hardness backing their currency with this monetary expansion.

Let’s take a look at what drives the value of Bitcoin…

Global liquidity has fallen due to the U.S. tampering with its money supply which is down 4-6% year to date. Our chart indicates this by the gold line cutting through the trend line. Usually, when liquidity increases, Bitcoin goes up in step or with a slight lag.

According to Raol Pal, the Global Liquidity Composite demonstrates the rising money supply. However, according to my Trading View charts, it does not appear to be increasing. I believe more liquidity is soon to come.

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.