Today’s Nuggets

Falcon Sensor Crash Windows Globally, Bitcoin Not Affected!

Blue Screen Day, Bedlam Everywhere

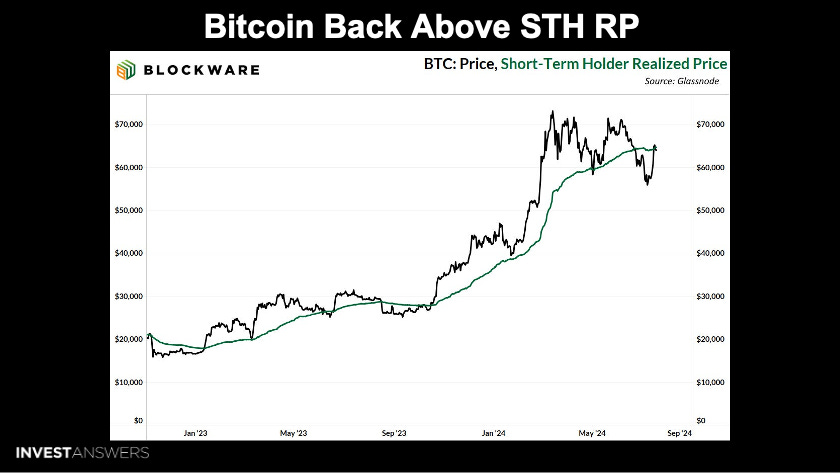

Bitcoin Loves a Crisis, Back Above Short-Term Holder Realized Price

The Cup and Handle BTC Targets

BlackRock Dominating and Bitcoin Game Theory has Begun

Solana on the Verge of a Massive Breakout

21Shares Launch Injective ETP

MSTR Up 50% in 14 Days, #281 on S&P 500

ICE Dying, BEV Growing Tipping Point

The Chinese Dump of the Dollar

In this story, I will weave together a complex tapestry explaining why centralized systems are bad. Many crazy things are happening around the world right now, it is mind-blowing. There are many moving parts and everything ties into everything. As I always say, there is connective tissue between everything that we touch in this world.

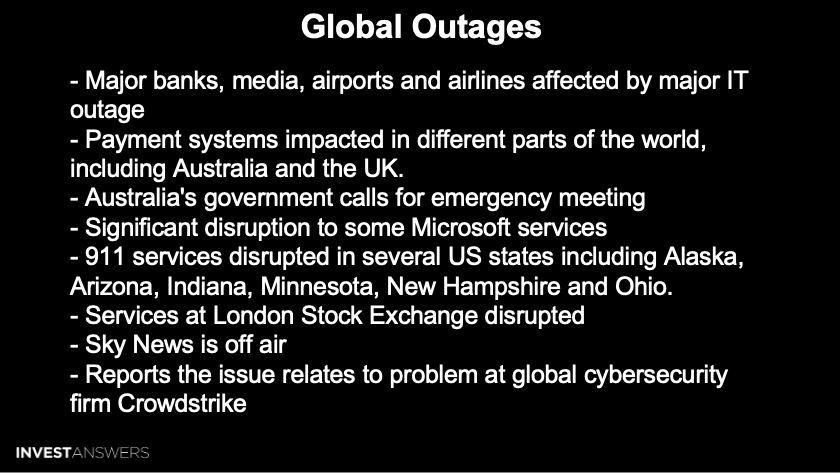

There has been a major global IT crash with planes grounded, media paralyzed, 9-11 disrupted, and Microsoft CrowdStrike in the spotlight.

Guess what? Bitcoin is four and a half thousand dollars higher in the last day or so!

Crypto Market Update:

The crypto market cap is $2.45 trillion, volume of $75 billion.

Bitcoin is at $67,400; this is an insane breakout.

Fear and Greed is 60.

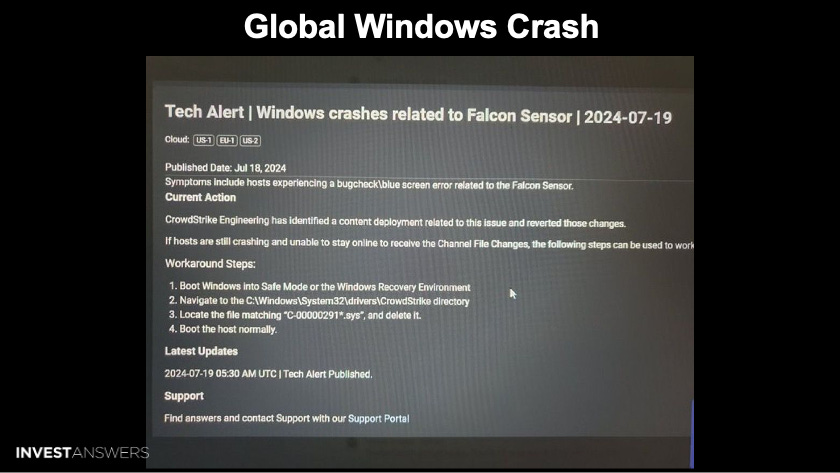

What exactly went down and what has stopped the planet from working? This really tells the story of the vulnerability of centralized systems. If you try to transfer money in and out of a bank, in and out of Schwab, or anywhere like that, you could not do so yesterday. This is due to the Windows blue screen of death everywhere.

By the way, I stopped using Windows about 15 years ago because it was a pain in the backside and it was crap. I did not realize the world does not run on Linux or Unix-based systems and everything is interconnected, which is dangerous.

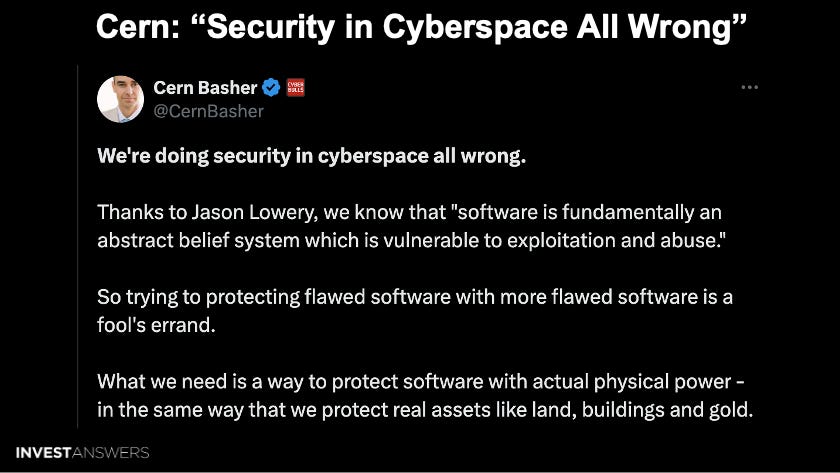

There is now a colossal reliance on these centralized systems and one software vendor that is supposed to protect them. It is bizarre.

Why do we care?

I have always said Bitcoin loves a crisis.

Every time there is a banking or global system outage crisis, Bitcoin never misses a beat and goes up big time!

Mainstream media being out is a good thing. In parts of the world today, you cannot move money or make an emergency call, so this is a very serious outage.

One of the things I forecasted for 2024 was a lot more hacks and cyber ransomware. These recent issues are apparently just a glitch. However, they show why it is so easy to take the world down, which is crazy. The world is becoming more interconnected, centralized, and fragile by the day.

A lot of people are checking out of work, but here is a shout-out to all the IT professionals who may have to work for the next 72 hours straight to fix things because there is chaos everywhere.

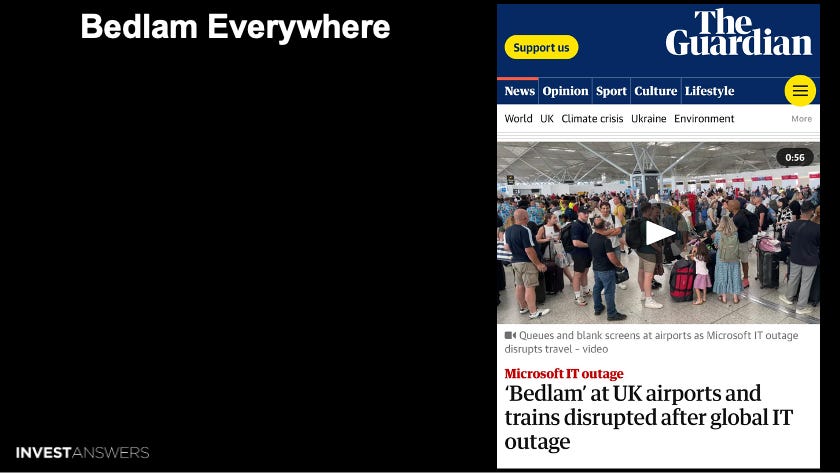

This is a picture from The Guardian of passengers who described the bedlam at UK airport check-ins after the global IT outage. In India, they hand-wrote a ticket for an airplane as a boarding pass. It is bizarre. The world is becoming so fragile and very scary.

We need a life raft and a lifeboat for safety against all of this.

Let us examine the complexity of fixing this.

The faulty update provided by CrowdStrike is forcing the affected PCs into a blue screen of death. Cyber experts recommend booting Windows in safe mode, navigating to the directory C system 32, and then deleting the entire system 32 directory.

I stopped using Windows 15 years ago because it was such a pain in the butt. Let this be a lesson to everybody.

Surprisingly enough, the CrowdStrike stock is not affected that badly, which is bizarre.

Bitcoin shot up to $65,000 and now it is up an additional $2,500 in a matter of a few hours.

Once again, Bitcoin loves a crisis.

It was very important for us to get above that 200-day moving average for Bitcoin earlier this week. I was watching that like a hawk. We are now way above the short-term holder realized price. During bull runs, if you get the dream-like scenario of being able to buy under the 200-day moving average, it is a golden opportunity. Even just buying under the short-term holder realize price is a dream.

Thank you, Germany, for bringing the price down. It is very rare for this to happen in a bull market.

This is all code for Bitcoin.

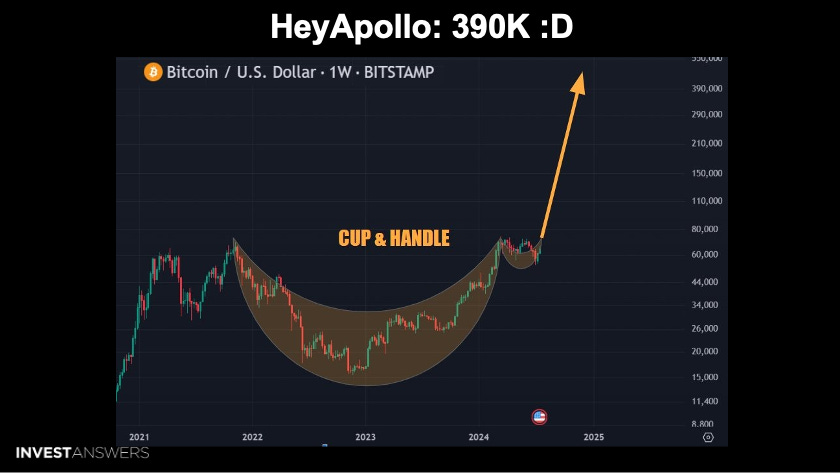

We had an active discussion on DCA this week regarding Bitcoin on the weekly, showing a cup and handle. Per Marty's cup and handle for Bitcoin in our weekly TA segment, targets remain at about $120,600 to $127,500. Marty added the importance of the event zone of the U.S. election, which I think is November 5th, with the target going out to June 16th of 2025.

Again, think of the next nine months to be a very good time.

@HeyApollo also had a cup and handle and his target is a little higher at $390,000 here on the weekly chart. But this could become real if you believe in these signs, as some people do.

This article made one of the most bullish statements on crypto ever. I have spent seven years talking about Bitcoin game theory. All of a sudden, one event triggers a lot of people to think about Bitcoin game theory.

This is from a presidential candidate, DJT. He said, if we do not do it, China is going to figure it out, and China is going to have it or somebody else. This is what we have been waiting for seven years. Satoshi mentioned this at the very beginning, 14 years ago, and here we are. We could be on the cusp of something really, really big.

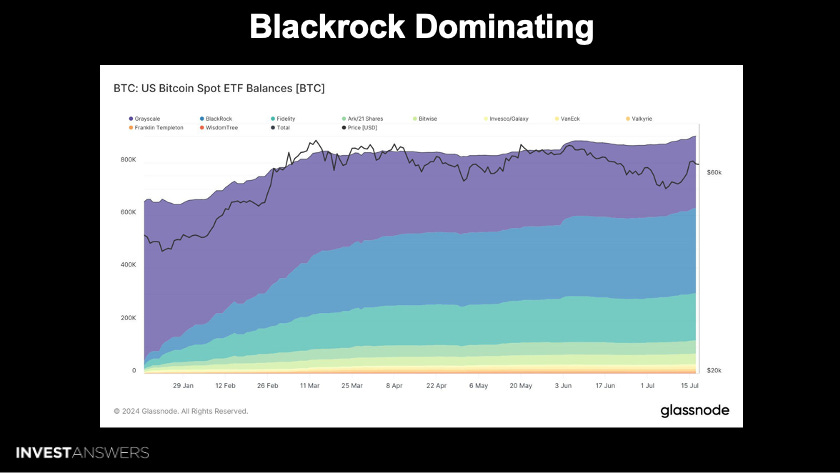

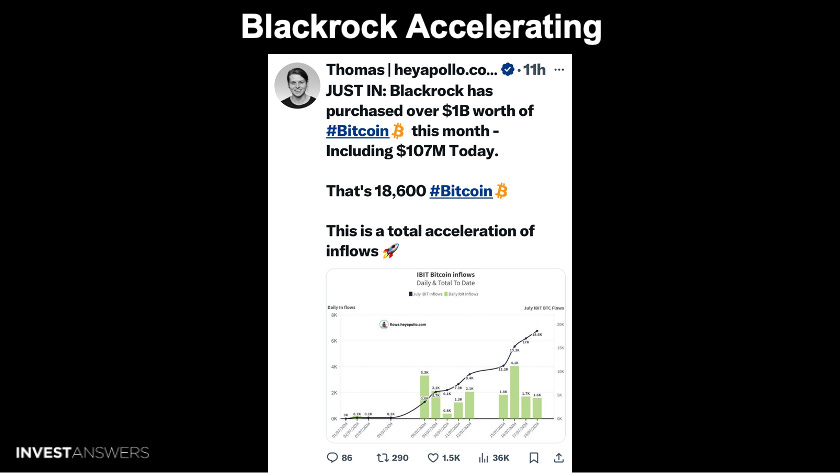

BlackRock is the big blue wave in the middle of this chart. Grayscale is the purple at the top, which is shrinking.

BlackRock has purchased nearly 19,000 Bitcoin in two weeks. The Bitcoin miners make 450 per day.

For years, I have been studying the QQQ and Bitcoin charts, the lack of correlation between them, and/or the correlation in some cases. This is an interesting article that points out how Bitcoin has recently defied the slump in tech stocks.

Let us look at Bitcoin versus QQQ and see where we are.

For years, I have been studying the QQQ and Bitcoin charts, the lack of correlation between them, and/or the correlation in some cases. This is an interesting article that points out how Bitcoin has recently defied the slump in tech stocks.

Let us look at Bitcoin versus QQQ and see where we are.

The top line shows the Bitcoin price and the teal green is the QQQ. Year-to-date, you can see we had a massive rampage until May. Then, Bitcoin chopped sideways for nearly 90 days because that is what happened after the halving. So far, Bitcoin is up 51% YTD, and the QQQ is up 18%.

What is important to study as well is the divergence between both. QQQ has basically pooped the bed at the same time that Bitcoin started to recover. The perfect inverse correlation is money.

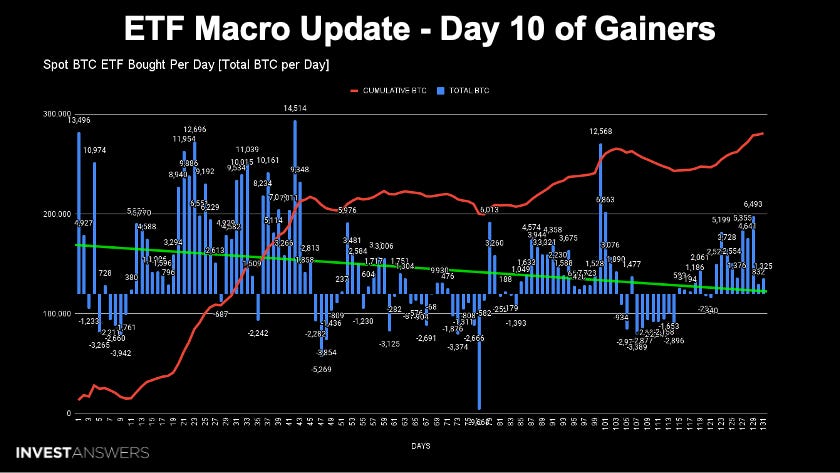

Ten days in a row of positive flows, a huge amount into BlackRock, and they are accelerating. This is what I call stage three of ETF accumulation, which has just begun, and it will be good.

This is Solana again on the weekly, forming a pattern like the cup and handle for Bitcoin. If you believe in these patterns, SOL is on the verge of a massive bullish pennant breakout.

As Marty has been warning,

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.