Today’s Nuggets

DeepSeek versus Bitcoin

The Ever Changing U.S. State SBR Map

The Bitcoin Alchemist and Volatility Virtuoso

FASB Rules Impacted Tesla… MSTR Next?

The Tamper Proof Currency

China Permits Bitcoin Ownership?

Bitfarms Adding 25 EH/s by September 2025

The Paradox of Scale

Euphoria has Not Arrived Yet

Saylor + ETF Impact on BTC Price & Multiplier

Yesterday, I posted about AI predictions for the price of Bitcoin, which got some attention from people.

The question I get is, can we hit 175K? My job is to answer questions, so I will try to answer this one today.

Fred Kruger had an interesting perspective on AI and DeepSeek.

I thought these statements were very profound because there is a huge correlation. I have been discussing the correlation between the QQQ and Bitcoin for years. Bitcoin is considered a risk-on asset, but since DeepSeek happened, it put a bit of a torpedo shell in the hull of the whole AI narrative.

I believe the DeepSeek narrative is overblown but things get overbought and then get oversold. It is how markets work.

Shout out to South Dakota.

At this stage, the whole country will be doing them. Europe and other places all over the planet are waking up.

The Buckeye State is also coming around to the SBR.

The reserve bill passes out of the committee and these SBRs are spreading like wildfire.

This map is only a day old and already out of date.

Soon, the map will be all gold!

As I covered before, there is a huge correlation between red states and Bitcoin. The left and the right coasts are always the last to follow.

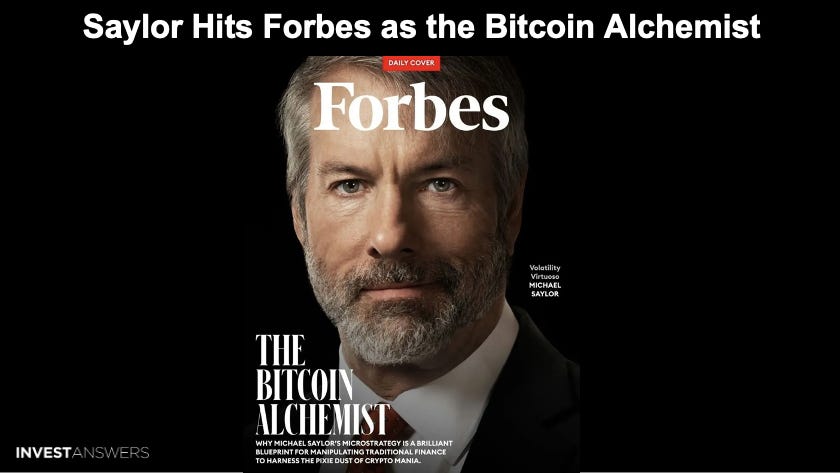

Michael Saylor hits the Forbes magazine cover - a big deal.

They refer to him as the Bitcoin alchemist and the volatility virtuoso. Because MSTR is in the quiet period, Michael Saylor is not ATMing today.

Therefore, the MicroStrategy price is going up.

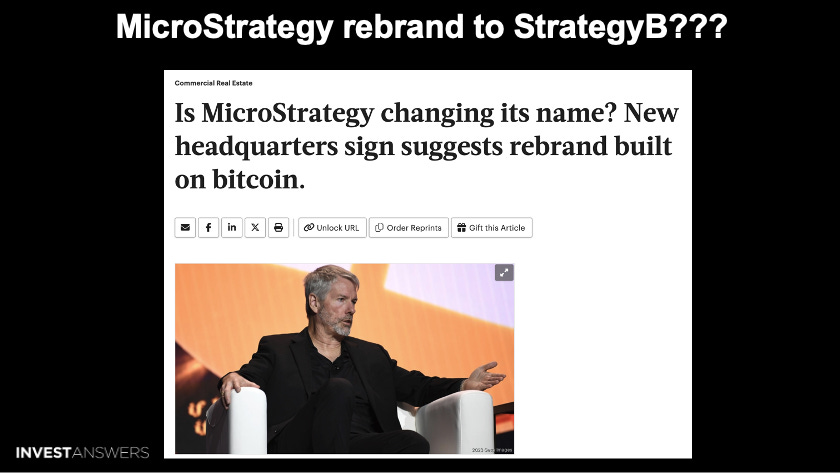

In a real estate magazine, it is rumored that MicroStrategy will rebrand to Strategy B.

This would show how they are completely focused on nothing but Bitcoin.

Yesterday, in the Tesla earnings call, we saw the huge impact of how Tesla had marked up its Bitcoin holdings, booking a $0.6 billion gain on their Bitcoin bag.

They own about 1,500 Bitcoin and shares are up in after hours.

Just think about what would happen if MicroStrategy does the same thing. It is theoretically possible that MSTR could be trading at a P/E of 5 depending on exactly how they market the Bitcoin they hold, and that all ties into the Bitcoin yield as well.

The European Parliament representatives want Bitcoin as a tool for protecting against inflation and state control.

Rene Aust is a member of the German AFD party. The AFD's party platform is

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.