Today’s Nuggets

Bitcoin Shorts Steamrolled

FBTC and IBIT on Fire

The BTC Step Change Trend

Global Liquidity has Risen 17% YTD

Wyoming Engaging in Game Theory

Fundstrat’s Exec Forecasts BTC Bound for $175,000

Solana Dominates dApp Revenue

Tesla and MicroStrategy Top Performers

What Bitcoin Yield Means

China is Not Dead, Still Growing

It is Friday Fire and what a week... things are insane!

How things have changed so much since Monday. The crypto market cap is now $3.65 trillion with volume of $161 billion. Bitcoin is over $105,000, which is hard to believe as it has increased 17% since Monday. It is a $2 trillion asset!

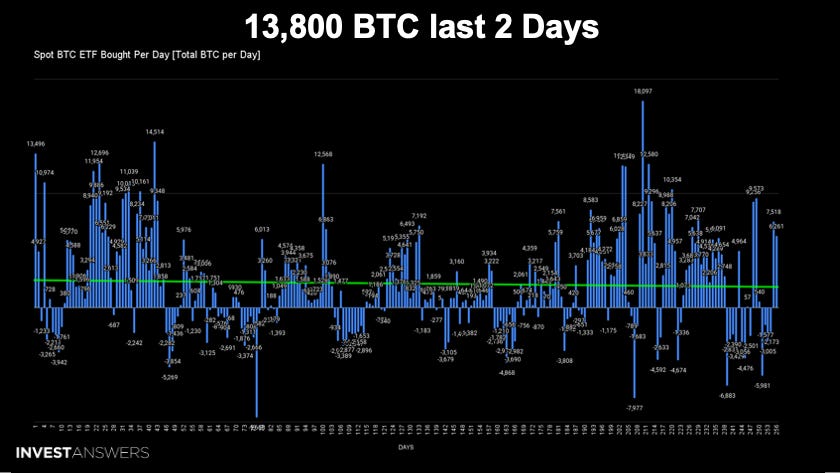

The Fear and Greed is at 75. The ETFs had the 10th and 11th largest days in over a year as Fidelity and BlackRock were on fire as nearly 14,000 Bitcoin were grabbed.

The Fear and Greed is at 75, and people are very greedy. Yesterday, it was 75 as well.

We found ourselves in the neutral zone last week and for the month, it has been in Extreme Greed around 81.

You might get some Extreme Greed this weekend because crypto is bullish on weekends.

Stocks are still in the fear zone at 38.

Again, this is a very different world but things are breaking that will change this in very short order.

Joe Consorti says the shorts are getting completely rekt.

They are getting crushed right now and they are scrambling as there is no short wall against Bitcoin at an all-time high. The bulls are completely in control because of the narrative, which will break down in a second game theory, kicking into high gear.

It is hilarious the trad-fi ETF buyers sold a bunch at the bottom and are now scrambling to buy back as their timing is awful.

We had the 10th and the 11th largest days ever in the history of these ETFs, which have been in place just over a year and closing out 265 days of trading days.

The red line is BlackRock and the blue line is Fidelity.

Both of these funds are on fire. Fidelity had their biggest day in history - in dollar terms - just the day before yesterday.

BlackRock has been super strong all the time.

These two funds alone bought nearly 14,000 Bitcoin in the last two days.

However, it is not the biggest day in Bitcoin consumption because now, instead of buying Bitcoin at 42,000 and 56,000, they must buy it at 100,000.

Your dollar goes

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.