NUGGETS OF ALPHA

Digital asset investment products saw inflows of $1.1B; YTD inflows to $2.7B

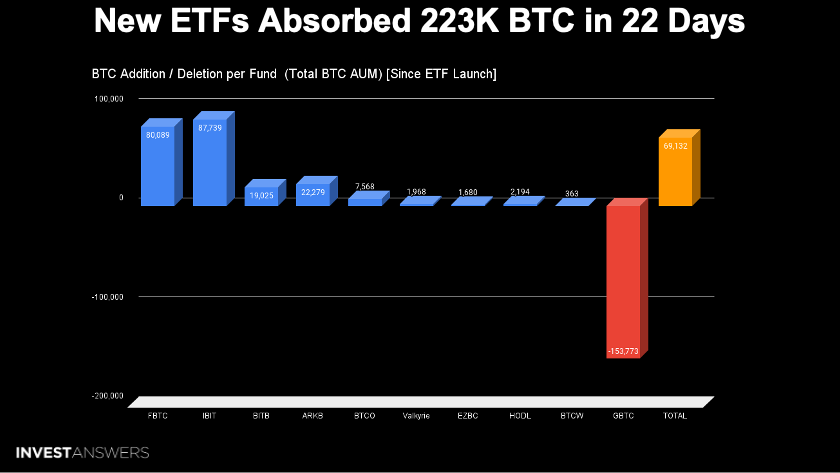

The new ETFs are seeing inflows of 500M or 10K BTC per day

The ETFs now own 3% of Bitcoin with 10K BTC per day average of inflows

F&G are at extreme greed levels

On Chain signals are mostly very bullish

U.S. adults lost a record $10B to fraud in 2023, up from $8.9B in 2022

What we experienced in the markets Tuesday is just the nature of crypto and Bitcoin. The more experienced investors embrace the volatility for snipe opportunities and create call options.

IMAX, STX, and HNT are in the dark green this week

SOL beat BTC by 1.5%

When you zoom out for perspective, you realize that it has been a very good week:

BTC +15.23%

ETH +14.42%

SOL +16.94%

AVAX +15%

Here are the key crypto stats over the last four months:

$1.87T is the market cap close to $2T and headed to $5T

7.2M active addresses this week versus 5.6M

56M transactions versus 40M

The Bitcoin halving is approximately two months away. We are in the beautiful pre-halving run pocket, where prices have exploded historically.

Digital asset investment products saw inflows of $1.1B, bringing year-to-date inflows to $2.7B. The assets under management are at the highest level since early 2022 at $59B. We are still early. Catch my Daily ETF Videos on Youtube.

The ETFs now own 3% of Bitcoin. At this rate, 10K BTC per day are going into these funds. For many, it is vexing to see this data related to the amount of absorption and the price of Bitcoin going down. Two primary reasons the price is declining:

Galaxy Digital Global is selling its $1.6B BTC stack right now

Risk assets got rattled by the CPI report this morning

However, half a billion dollars come in every single day from the new ETFs. This is akin to

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.