Today’s Nuggets

Tom Lee’s $100K BTC by Y/E

BlackRock’s Flows Beat 3,000 other ETFs

48/48 Win Rate

Michigan Accepts BTC

Bitcoin Smokes Gold

BlackRock Quitely Doubling Down

This is a Moonvember to remember. Our bags are going to the moon and it is one of the best we have had!

We did have the rate cut yesterday (25 basis points) which we all knew would happen. This contributed to Bitcoin smashing $77K and reaching another new all-time high.

The crypto market is very bullish, sitting at a $2.7T market cap, and all our bags are pumping. Tesla is up 55% in 16 days, making a monster move.

There is a bit of confusion from this floating around the internet today.

Tom Lee, a fellow Wharton alumnus and a great guy who is a real guru, was on with Joe Kernan on CNBS. They spoke about Bitcoin Magazine, which predicts a $150,000 by year-end, which is not correct.

You have to listen to the source of the truth and Tom Lee said it will be ‘six digits’ by the end of the year.

He spoke about Bitcoin becoming a treasury reserve asset that could help the U.S. fix the deficit. This is the same stuff that RFK spoke about and was discussed at the Bitcoin conference, by Trump.

This is not new but is good to hear Tom Lee spreading the good word on CNBS.

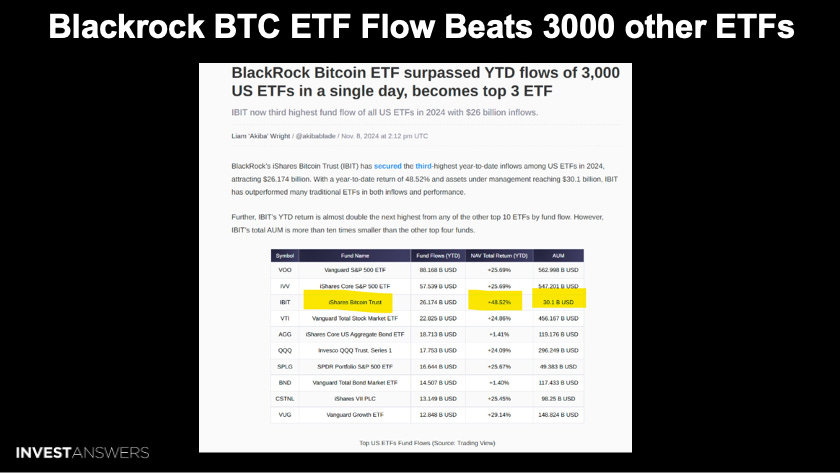

BlackRock year-to-date beat the 3,000 other U.S. ETFs in a single day.

This means that BlackRock's IBIT has achieved one of the highest - if not the highest - year-to-date fund inflows amongst U.S. ETFs in 2024. IBIT is the third largest by overall inflows, up against things like the QQQ and the SPX.

It is a monster investment but also a scarce asset. The crunch is coming and I have never been more sure of that before...

Liquidity is also coming.

China announces a $1.4 trillion program to refinance local government debt, supplying a massive liquidity injection. The U.S. is still printing.

The next five to six months will be huge for Bitcoin and crypto.

Here is a nice succinct list to lay the groundwork for the direction we are going.

By the way, we are getting into the season now when you start to get phone calls from friends and family asking if they are too late to buy Bitcoin.

BlackRock is sneaking in the back door as quickly as they can.

Germany dumped their Bitcoin, which cost over a billion for their people.

The country sold its 50,000 Bitcoin at $54K. Now it is $77,000.

The lesson: you do not sell hardness.

This is the German parliament member who urged Germany not to sell its Bitcoin.

She is a wise lady but they did not listen to her. What she did say is if the U.S. buys Bitcoin as a strategic reserve, then all the European countries will get FOMO. It will not just be in European countries but globally and instantaneously,

FOMO will set in as it is a very scarce asset.

This is exactly what Larry Fink sees at BlackRock and is why he is getting in early and hard. This is the most important thing in investing.

Let

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.