One of the things that has come to my attention over the past month or so is that many people do not have enough Bitcoin or any at all.

I will explain how to fast-track to accelerate your Bitcoin stacking. Today, I will revisit the past, demystifying how MicroStrategy works and breaking down the numbers because people still do not get it.

In addition, we will cover what could happen over the next 10 years and how you could boost your Bitcoin bag.

MicroStrategy treasuries are exploding!

They are $41 billion, which would put them literally number seven in the top companies on the planet with treasuries.

Per this list, you have Apple, Google, Amazon, Microsoft, Meta, GE, and MicroStrategy.

Where the hell did this thing come from?

Saylor is a special guy who has been on the channel a couple of times.

Saylor reaffirms his intention to have his Bitcoin keys destroyed when he passes away, describing it as a pro-rata contribution to everyone who owns Bitcoin.

As he said himself, he is carrying the torch for Satoshi, which is very touching.

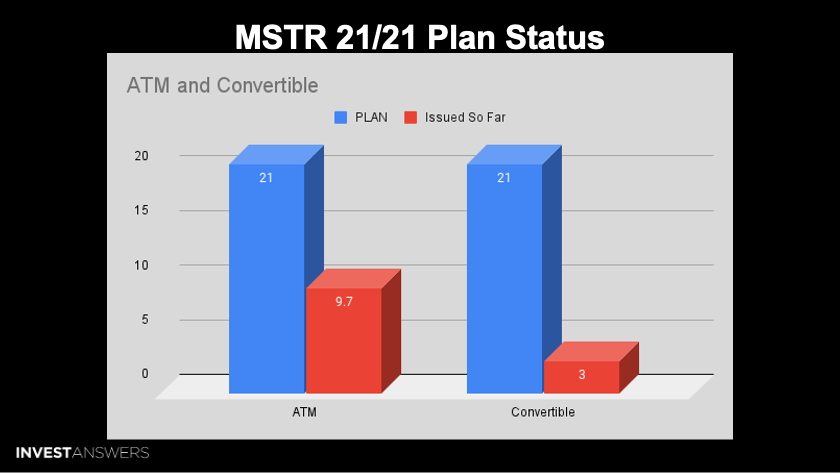

At its earnings call, MicroStrategy talked about its 21/21 Plan.

The 21 plan was the number of ATMs or the amount of stock and convertible debt they would issue over the next three years.

So far, over three years, MSTR has issued $9.7 billion in ATMs. They have only issued $3 billion in convertibles. So that is 14.29% in bonds versus 46.19% on the ATM.

They have blown nearly half of the three-year allotment in weeks!

If you assume that MSTR will stick to the 21/21 Plan, you can see that the ATM is now 3.23 times larger than the convertible. I think they will do a lot more than that, due to the infinite money glitch.

You can see that the ATM is now 3.23 times larger than the convertible. Consider blue being the allocation and red being what they have in a matter of weeks.

As you know, we have been looking very carefully at the amount of outstanding shares going back to April 2021.

I have been tracking this since August 2020, and there has been a big spike up to nearly 225 million shares outstanding, up from a base of about 98 million at the beginning of April.

Do not forget that a stock split happened 10-for-1. If you were in this before the split, that would translate to about 22 million shares.

A split does not make any difference but

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.