Today’s Nuggets

BTC ETFs Daily Inflows Greater Than Gold ETF Flows

BlackRock’s IBIT Holds Over 300K BTC

Why BTC Price Has Fallen Despite ETF Inflows

OTC Desks Restocked

Record Shorts Set on BTC

Whales Stacking by Hunting

Coinbase’s Trading Volume Tanks

Cash and Carry Trade

Bitcoin Fees Mooning Again?

Today's story will focus on manipulation - a huge subject of interest and debate within the hardcore Maxi community and other communities.

BlackRock is the world's largest asset manager that has made huge moves in the cryptocurrency space. They have the ETF, which has made Bitcoin a bona fide asset.

This has led to discussions about the potential for manipulation, especially given the tools at BlackRock's fingertips.

Bitcoin is up a paltry 3.1% for June despite record-breaking flows. We are only eight days into the month - it is still early!

It took gold ETFs five years to cross $15 billion in inflows.

The new ETFs - in dollar terms - have taken in $33.6 billion in inflows for 103 consecutive days. This does not include GBTC.

That - of course - changes the calculus a little bit…

ETFs have taken in a ton of money in a short window, and it took the gold ETFs a long time to get there.

BlackRock holds over 304,000 Bitcoin as I speak to you now, which is a very big bag of Bitcoin, considering there will never be more than 14 or 15 million Bitcoin - a staggering amount.

Again, this is just one person's point of view, but it is extremely poignant and sad when you read this.

Some of the highlighted points are true but perhaps not entirely. I will remain fair and objective, as I always strive to be.

Many people are talking about the same thing.

Many are very upset… trust me, I hear and see it in the comments.

Yes, our friend Gary Gensler will be telling BlackRock and JP Morgan what to do!

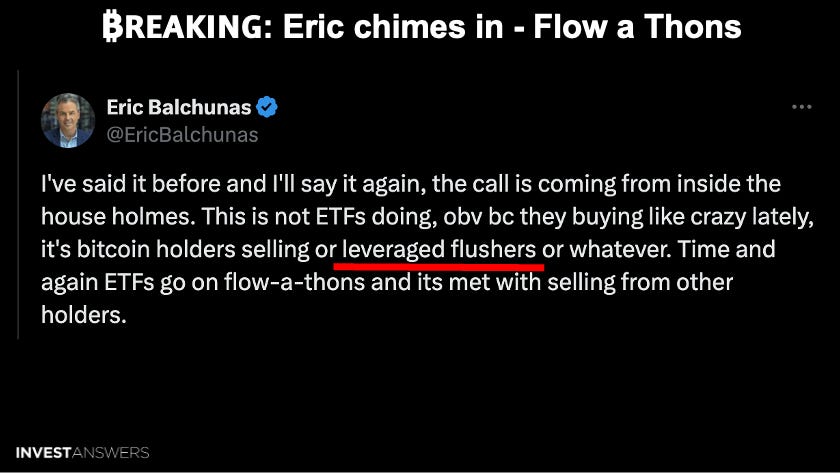

Eric Balchunas supplied a very fair response.

From the data I see, I do not see much selling happening - other stuff is going on.

I am going to try to pinpoint it.

I will take a couple of different angles today with this explanation and summarize it all at the end.

We will embark on a little tour and show the new IA Multiplier.

If you look at the blue line at the bottom going up, that is the balance in the OTC desks. Per this chart from CryptoQuant, they have about 200,000 Bitcoin. This is a big bag, but it is spread around with Kraken, Coinbase, Binance, and many other groups.

According to this chart, the OTC desks have been stacking through the end of May, as represented by the pink area line.

The point is, if BlackRock or any ETF wants to fill its bags, they can reach out to an OTC desk and have the supply for now.

Bitcoin did get dangerously low in supply, but now it looks like they have been replenished.

In addition, we have hedge funds shorting Bitcoin like never before, which ties into the futures manipulation I spoke about at the beginning.

The ‘hedgies’ are shorting this thing like it is going out of fashion.

These are the 100 to 1,000 Bitcoin whales. These are not the ETFs that are stacking here.

Who is selling to these whales?

Here is the BTC liquidation heat map for Binance. You can see that people still go leveraged long on Bitcoin and the whales manipulate them by wicking the price down.

I spoke about leveraged long hunting yesterday and the day before. Perhaps this is how the whales are filling their bags?

They are

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.