This Bitcoin Conference has been really interesting. The day two recap will include a couple of bangers, including Snowden. This is a "rough and ready summary" and is lengthy, with 60 nuggets.

We will discuss how Larry Fink got ‘orange pilled’ and spend a lot of time on the Saylor show because it is phenomenal.

It covers all of the stuff that I have been talking about for years. Saylor talks about how everything melts away except for one thing. We will also get to his price targets, which are very heavily sandbagged but also interesting.

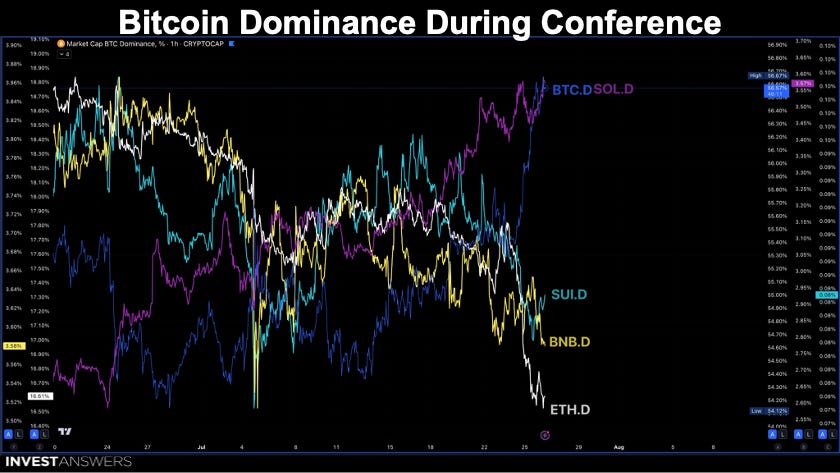

You can see that during the conference, dominance for everything has fallen except for Bitcoin dominance and a token that will remain nameless. Bitcoin is strong and we are back up close to that $68K level not too far from the all-time high.

As you know, I am a big believer in Bitcoin in the balance sheet. This is why my biggest position is MicroStrategy, because it works. This has been, by far, the biggest trade of my life. This panel consisted of:

Andrew Kang from MicroStrategy;

Eric Semler from Semler Scientific;

Simon Jerevich from MetaPlanet in Japan; and

Dylan LeClaire from Bitcoin Magazine, who also is an advisory director to MetaPlanet

I know plumbers in San Francisco and I orange-pilled them to put Bitcoin on their balance sheets. Now, their plumbing balance sheets look pretty robust.

Let us explore why anybody would want to do this.

Hedge Against Inflation and Currency Devaluation: Bitcoin serves as a hedge against inflation and currency devaluation. For instance, Simon Garich highlighted Japan's economic stress and devaluation of the yen, making Bitcoin a viable asset to preserve value over time.

Enhanced Shareholder Value: Companies like MicroStrategy have seen substantial increases in their share prices after adopting a Bitcoin strategy. MicroStrategy's market cap increased from $1.2 billion to approximately $35 billion over four years, demonstrating significant value creation.

Improved Liquidity and Trading Volume: Bitcoin on the balance sheet attracts higher trading volumes and liquidity. MicroStrategy saw its trading volume increase from 100,000 shares a day to as much as a million shares a day, providing better liquidity and market interest.

Positive Market Perception and Investor Interest: Companies adopting Bitcoin see increased interest and enthusiasm from both retail and institutional investors. We saw that in a big way when it came to people wanting exposure to Bitcoin before the ETFs. Then everybody said, “oh, MicroStrategy is going to die after the ETFs as there will be no purpose for it anymore”.

That is not the case!

Low-Cost Capital Raising: Bitcoin's volatility allows companies to raise capital at attractive rates. MicroStrategy issued convertible bonds with low interest rates (0-2%) compared to traditional debt markets (8-12%), providing cheaper capital. What a beautiful and fantastic trade.

Flexible Financial Tools: Bitcoin-backed strategies enable the use of various financial instruments like convertible bonds and at-the-market (ATM) equity programs, enhancing capital structure flexibility and maximizing shareholder value.

Alignment with Modern Financial Strategies: Adopting Bitcoin aligns companies with modern financial strategies and technological advancements, demonstrating forward-thinking and innovative approaches to treasury management.

Corporate Treasury Diversification: Holding Bitcoin diversifies corporate treasury and reduces reliance on traditional fiat currencies, which can be subject to economic policies and central bank decisions that may not favor corporate interests.

Increased Public and Media Attention: Companies with Bitcoin on their balance sheets receive heightened public and media attention, which can lead to greater brand recognition and reputation as innovative market leaders.

Potential for Long-Term Appreciation: Historical data suggests Bitcoin's potential for long-term appreciation. Companies like MicroStrategy have leveraged this, believing in Bitcoin's future value increase to further enhance their financial positions and shareholder returns.

The next session is from:

Jimmy Song;

Luke Rutkowski; and

Ben Askren

Self-Sovereignty and Individual Responsibility: Bitcoin promotes self-sovereignty, a key American value. It empowers individuals to take control of their finances without relying on third parties or government intervention, reflecting the self-reliant spirit that founded America.

Freedom and Liberty:

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.