Today’s Nuggets

Miner Block Rewards Hits 16-Month Low

Pelosi Trades Corner

Bitcoin Ballet

SOL ETFs Dependent on the ETF

Real-World Asset Transactions Peaked in April

ETFs Rage Back

PayPal’s PYUSD Supply Surges 90% Post-Solana Expansion

Twelve Tesla Tailwinds

Elon’s SpaceX is by Far the Leader in Space

Cybertruck Killed Rivian

This OCTA will cover a couple of unique topics that we have never shared before.

We will discuss some government traders, examine some stocks we have never examined, and analyze some tailwinds behind some historic moves.

Crypto Market Update:

The global crypto market cap is $2.12 trillion.

The price of Bitcoin is $57,463.87, and BTC market dominance is 53.6%.

The Crypto Fear & Greed Index is down to 27.

I should discontinue this unlock stuff because it is almost the same name every week that keeps dumping. If something is not underlined in red, it means the unlock is tiny, and you should not be concerned.

As we discussed on DCA yesterday, unlocks are not a good thing.

If you are wondering why you are not making money on these things, it is because of the unlocks.

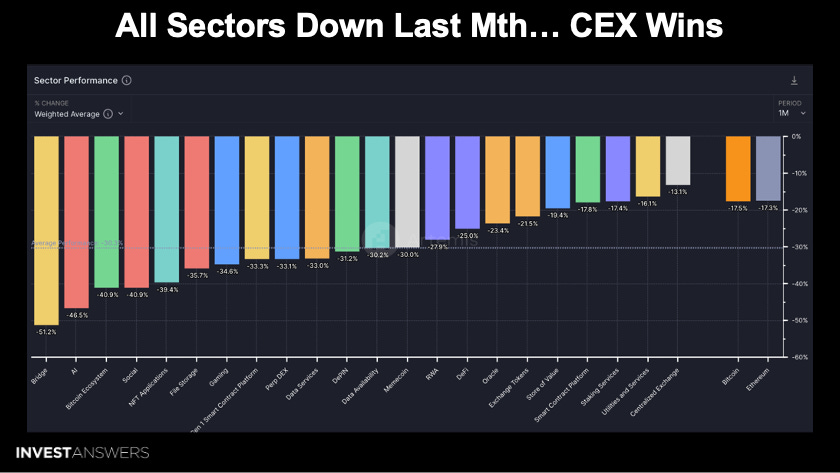

Everything in crypto has been down over the last month.

The least worst-performing sector is centralized exchanges. Bitcoin and Ethereum are down almost the same amount (~17.5%) over the last month.

I think this is stunning, considering over the last month we got the news that the Ethereum ETF was approved… and nobody cares!

Everybody is still very nervous.

I like to buy when people are nervous.

Miners were down hard, except CleanSpark which was flat.

The profitability analysis for the Miner Block Award is at a 16-month low, which will hurt all miners.

Mining is a cutthroat business, so be careful.

Let us break down a couple of Nancy Pelosi trades, as this caused a bit of consternation over the last 24 hours. Even though she discloses them, I think her husband (Paul Pelosi) executes the trades, or at least he used to. Since he got a hammer to the head, his timing has been slightly off.

First of all, from what I understand, Pelosi has sold half a million dollars worth of Tesla at around $170. Tesla hit ~$265 today.

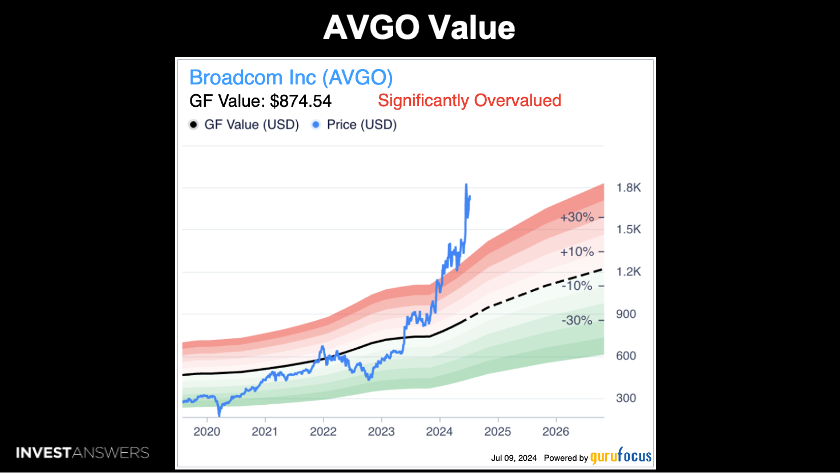

But Nancy did buy $5 million worth of Broadcom (AVGO).

Let us try to find out why and if we should buy Broadcom…

This is AVGO on the ATR. Nancy bought close to the buy signal on this model. So, maybe Paul is using the ATR model? But they are already a little bit in the money, in a short period.

I like value disruption and do not like buying things after they have gone up 5x.

Let us look at the fundamentals of AVGO as I know them today…

According to Guru Focus, AVGO is significantly overvalued.

When people ask me if I would buy AVGO, my answer is

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.