TODAY’S TAKE

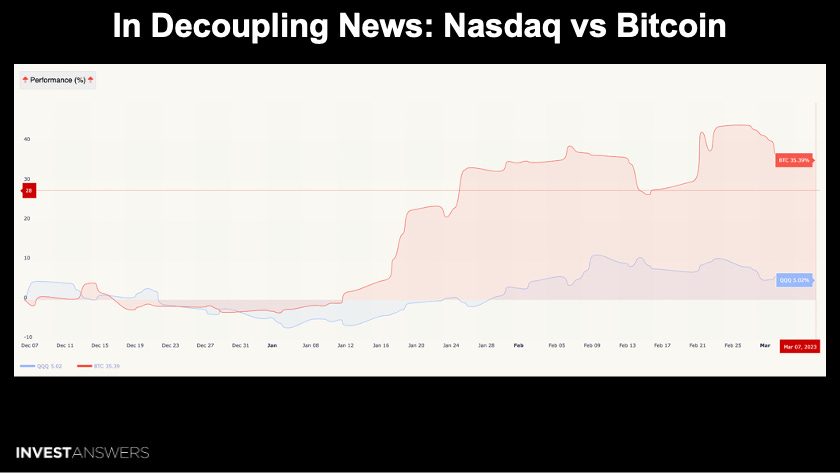

Last 90 days Bitcoin up 35.4%, NASDAQ up 5%

We are on the cusp of the BTC S-curve going vertical

Heavy option market bets for Bitcoin to reach US$25-40K by the end of March

BTC Put/Call ratio of 0.49 indicates a bullish sentiment

The Block released a Mining Development Kit for Bitcoin

Liquidity is drying up from the crypto market due to Silvergate Exchange Network

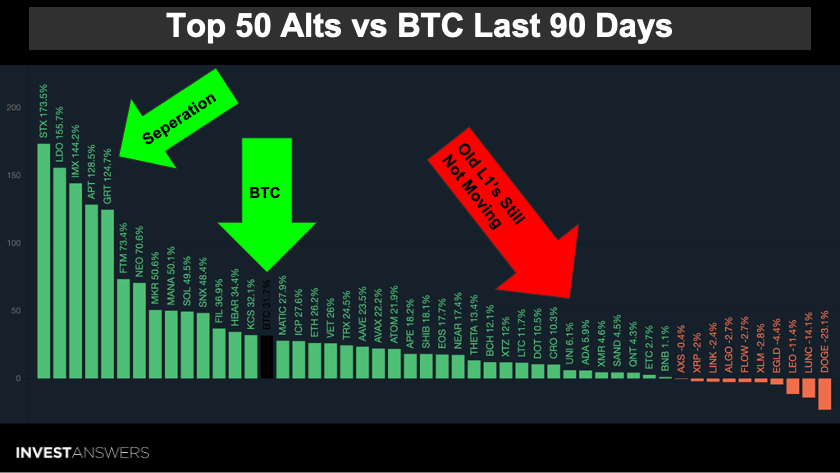

Bitcoin season hit this week

Investors factoring in the 50 bps increase in federal funds rate

U.S. LinkedIn Hiring Rate has falling 30% in 12 months

BRICS are looking to in trade in non-dollar denominations

U.S. dollar has fallen from 75% in 1999 to 59% at end of 2022 of world reserves

LIBOR surpassed 5% for the first time in more than 15 years

U.S. credit debt is heading to $1T

U.S. credit default swap is up 85% in the last six months

The IA team is committed to supplying the most breadth to help you on your journey to financial freedom. We touch on everything important to make good financial decisions in a data-driven way. Our YouTube video schedule is as follows:

Monday: DCA, Tuesday: OCTA, Wednesday: Crypto, Thursday: Markets, Friday: News/Interview, Saturday: Quickie, Sunday: Q&A from Patreon Members. Each month I will do a Global Macro Update, Global Real Estate Update, Crypto Miner Update and a DAU Deep Dive (Crypto Metrics)

There is a lot of hysteria with the markets’ pricing in 50 bps for March. A terminal Rate of 5.6% in October, combined with higher for longer calls. A triple-digit yield curve inversion, which is the most inverted since 1980. While an ongoing Grayscale case with the SEC highlights the crypto news. Gold and Silver are getting crushed.

But Bitcoin is unmoved and uncorrelated to Gold, U.S. equities, and DXY.

Small growth equities are the best-performing assets besides Bitcoin, which is the clear outlier on the chart.

Bitcoin (BTC) is up 35.4%, and the NASDAQ (QQQ) is up 5% over the last 90 days.

🟩 - % of Global Population Using Bitcoin

🟨 - Bitcoin Supply Issuance

Blockware’s visual makes it clear that we are darn early regarding the global adoption of Bitcoin. And it is becoming scarcer by the day! We are on the cusp of the S-curve going vertical.

This is an illustration of why Bitcoin is different and scarce. The key is the miners cannot adjust how much more supply can enter circulation.

This is the performance of the crypto market divided by Bitcoin.

Winners: XRP, Monero, EOS - bad score tokens run counter to the market.

Bitcoin is down 6.05% and Ethereum outperforms only down by 4.54%.

Plan B observes that Bitcoin RSI is stuck at 45, but we are nearly 72% through this halving cycle as we approach the light blue area on the chart.

If we go back to 2015, you can observe the same RSI. Notice the similarity in the structure and colors in the chart that lead to repeating 70-80% of the time.

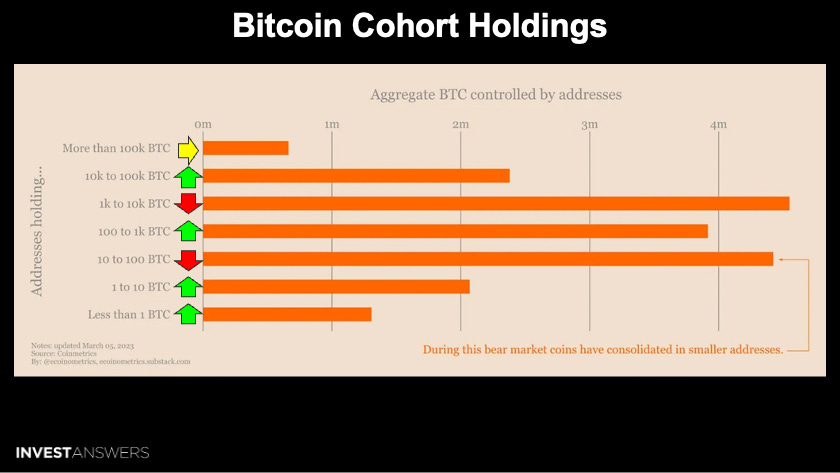

I added the arrows in the left-hand column of this chart supplied by ecoinometrics.

🟩 - Accumulating

🟨 - Flat

🟥 - Selling

This is the same dataset in a different visual. The 10-100 BTC cohort that has been accumulating for over 18 months suddenly started selling.

The 1K to 10K cohort has been selling off quite a lot - and for some time.

Interestingly, the emerging accumulation trend by the 10K to 100K has steadily been growing for most of 2023.

The HODLRs continue to Hodl, but liquidity languishes. However, the traders have left the market.

Still heavy to the right, with very little change since our last update despite all of the FUD. The open interest still bets for US$25-40K by the end of March. The Put/Call ratio of 0.49 signals a bullish sentiment.

Bitcoin has been moving up the chart steadily. Two weeks ago, it was right in the middle of this chart. This is primarily due to a move from stable coins into Bitcoin, signaling a flight to safety is taking place.

Today, the judges’ positions hinted at a favorable outcome for Grayscale and the many firms looking to launch a Bitcoin ETF in the United States. However, there is a long road ahead full of complications.

Artemis sentiment chart indicates Twitter has gone flat and there is no excitement in the market for crypto projects.

Despite the Fed, tech is mostly up over the last seven days. TSLA is down 7% as the market still does not understand what the company is, which is good for the retail investor. Even Nancy Pelosi sold Tesla at the bottom in December.

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.