Today’s Take

Bitcoin is outperforming most of the crypto market in ‘23 besides the Layer 1s

Today, the Bitcoin hash rate hit another all-time high

Polygon has risen over 20% in the last ten days

Solana’s dApp store could be a game changer for the entire ecosystem

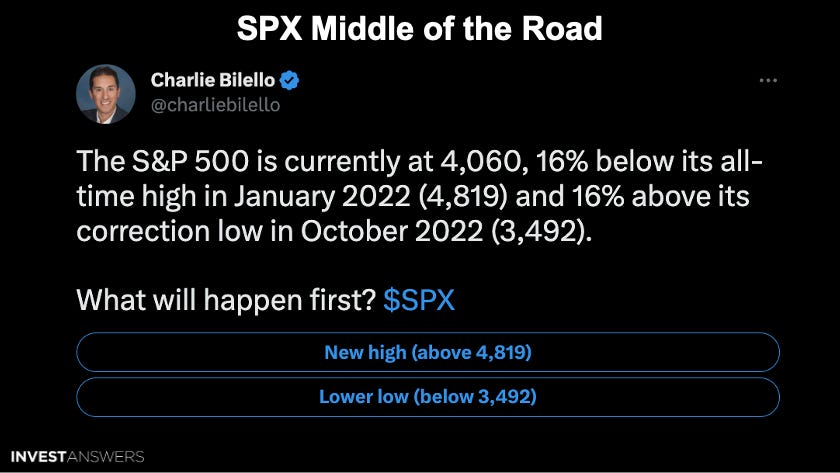

S&P is currently at 4,060, 16% below its all-time high in January 2022

Fed funds rate is now above core PCE prices for the first time since February ‘20

FOMC will likely wait for a terrible unemployment report or liquidity crisis before reentering monetary easing

Put and call options on U.S. equities have swung, indicating the market is going to risk on

Telsa Model Y ends 2022 as the world’s fourth-best-selling car on earth

Morgan Stanley’s new price target is US$220 for Tesla

More traditional names like Dow, IBM, and SAP are laying off thousands

Liquidity is what makes a world reserve currency, and USD is still King

One thing is for sure, fiat currency debasement is inevitable

I want to thank everyone in the InvestAnswers Patreon community, as it has been an interesting week. I appreciate all the gratitude and love received from the community. Glad to see many entering stocks for the first time.

Today we will talk about correlations, performance, and how the market is reacting.

Bitcoin is outperforming most of the crypto market in 2023 besides the Layer 1s.

39% for Bitcoin

32.6% for Ethereum

25% for Binance

Today, the Bitcoin hash rate hit another all-time high.

Bitcoin is up 10% over the last 90 days, so it has decoupled from tech equities.

Polygon is experiencing a lot of excitement around the project, rising over 20% over the last ten days.

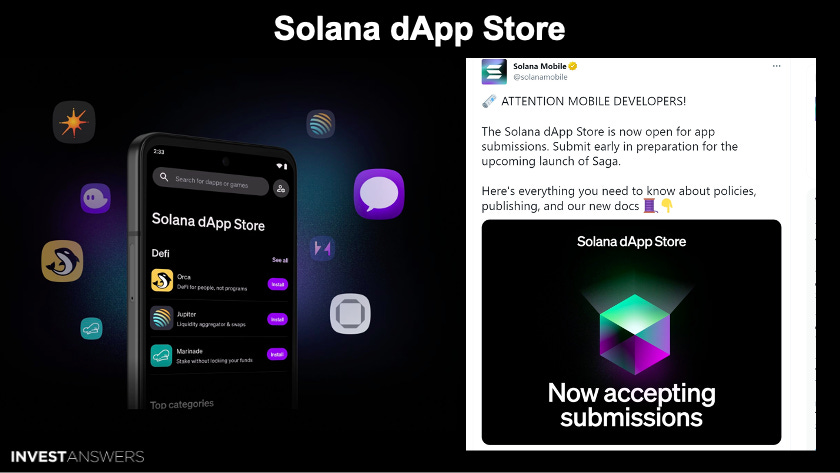

If you are building mobile apps, you should consider jumping into the Solana dApp store early. This could be a game changer for the entire ecosystem.

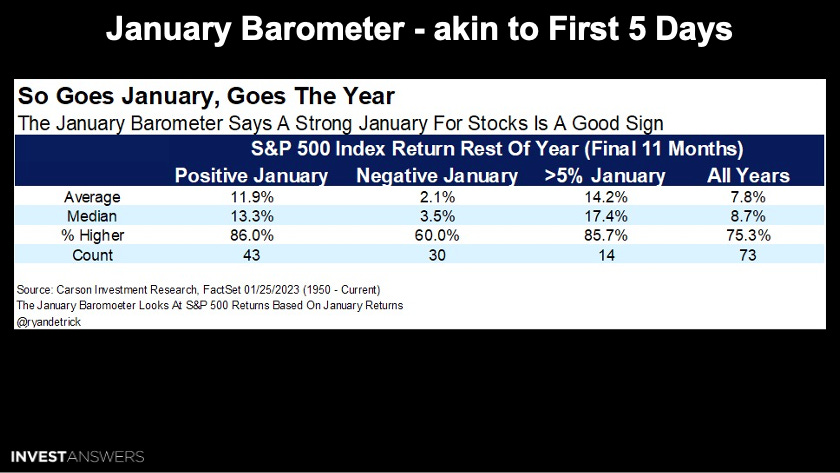

January is currently up 5.8%, with two days to go. This barometer has a fascinating history with strong correlations related to annual performance. 80% plus win ratio is good enough for me to pay attention.

The market is clearly on the move, with most of the big tech in a strong uptrend.

What is interesting is that Microsoft has not budged after all of the AI news.

Big pharma is lagging, so maybe their time is over.

Most analysts still forecast a lower low for the S&P 500 in ‘23.

The Fed funds rate is now above core PCE prices for the first time since February ‘20. The rate hike pause is imminent, with maybe two more 25 basis point raises remaining. After they pause, the FOMC will likely wait for a terrible unemployment report or liquidity crisis to move back into monetary easing.

⚫️ The market continues to price in rate declines below the Fed’s rate

🟣 The purple dots indicate where the majority of the FOMC forecast rates

🟡 The Secured Overnight Funding Rate falls well below the FOMC forecast

This is why the market continues to price in a fast pivot from a terminal rate of 4.755% to less than 3% in the near future. The recession-proof stocks should do just fine over the next 11 months.

According to the CNN indicator, we are on the verge of extreme greed in stocks.

The market has made a swing in puts since December. This indicates that the market is going to risk on fast.

This is a positive change for Elon Musk, and good to see this transpire for Tesla.

In ‘22, Model Y had 760K cumulative sales and lead in revenue for the year. In ‘21, it was the 15th best-selling vehicle. The production volume is up 88% over that period.

For comparison, Toyota Camry sold 670K (down 3%) and the Honda CRV sold 600K units (down 18%), respectively. The ICE is melting…

The CEO of Nordania, the Danish’s largest leasing company, shared with the media that they signed more Tesla new leases last week than they did in all of 2022. This is basically due to the price cuts.

Morgan Stanley’s new price target is US$220 for Tesla.

The Model T from Ford Motor Company experienced the same growth in 1913 after price cuts as Tesla is experiencing today.

Interestingly, from 1913 to today, the U.S. dollar has debased approximately 99%!

This trend will lead to a new record. In addition, recent cuts in new car prices are causing considerable problems in the used market.

Biden’s DOJ seems determined to smash big tech.

If the DOJ destroys Google, then who is next? Meta, Amazon, etc.

Now more traditional names like Dow, IBM, and SAP are laying off thousands.

The dollar has been dying since the post-Britten Woods era, which started in August 1971 when U.S. President Richard Nixon announced the "temporary" suspension of the dollar's convertibility into gold. However, the dollar is still the King among the universal currencies worldwide.

One thing is for sure, fiat currency debasement is inevitable.

Bitcoin is truth in a world drawing in political B.S.

Bitcoin is hope for those having their time stolen systematically with inflation.