Today’s Nuggets

IBIT’s Volume is Monstrous!

ETF without Staking Makes Little Sense

Democrats Continue to Pivot

WisdomTree Gets Approval with a Catch?

Miners On Fire

BlackRock Flips Grayscale

Today, we will break down all the action leading to a bullish setup. There is a bit of an ETF frenzy - a flippening - and a political pivot.

There is a thing called ‘Pizza Day’ that is happening as well.

I calculated the price of Bitcoin on all of these different pizza days and will show you the performance alongside some super interesting charts alongside crazy ETF flows.

Bitcoin has experienced a bit of a dip since this chart went up.

However, BTC is still up 16.5% for the month - not bad.

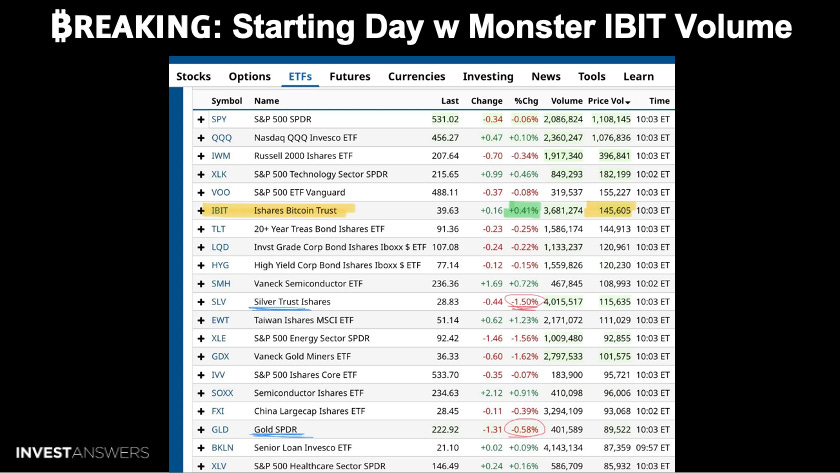

So far, the ETFs, including BlackRock, started the day with a huge volume pump per HODL 15 Capital.

You can see where iShares Bitcoin Trust ranks among all the ETFs on the planet. If you take out the indexes, there is nothing else but Bitcoin.

Volume is good because that means money is coming in.

Per HeyApollo's data, he believes that whales accumulated $6.3 billion worth of Bitcoin yesterday.

Transfers can happen behind the scenes and consolidation can happen that can skew these numbers.

However, if you look at the one-day change and the one-week change for shrimp, crab, and fish, it is quite disturbing. The sharks are essentially flat and have been stacking all this year.

The whales had a massive one-week change to 12,000 Bitcoin, nearly 9,000 in a day.

I will dig into that and compare this to my whale and analysis across all the different cohorts and see what we come up with.

Per Eric Balchunas, the ETH ETF could consume 10% to 15% of Bitcoin's assets. I believe Bitcoin investors are very different from ETH investors and that there is a snag with the ETH ETF.

If you have a bag of ETH and are going into the ETH ETF, you will not receive staking rewards.

This leaves a big chunk on the table, so it defeats the purpose of having an ETF in the first place.

This is why I do not think

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.