NUGGETS OF ALPHA

Digital asset investment products saw large inflows totaling $708M last week

The nine new ETFs absorbed 181,000 Bitcoin in 17 days

BTC HODLers migrating Bitcoin positions into the ETFs for custodial security

Solana’s 5-hour outage required all of the validators to perform a network restart

Solana ‘Chapter 2’ crypto phone reached 60,000 pre-orders

CleanSpark buy three “turnkey” sites to double its hash rate by summer

Tesla China had 10,600 registrations in February’s first week, up 22% YoY

Bloomberg reported that China’s sovereign wealth fund will intervene in the marketing, increasing its ETF holdings

Monero (XMR) price tanks 35%+ after being delisted from Binance

Nvidia’s top four customers account for 40% of its revenue—all are actively working on their own custom AI silicon

China is acutely aware of the need for humanoid robots due to their demographics

Per Bloomberg, Japanese shipper MOL says Rea Sea disruption could last a year

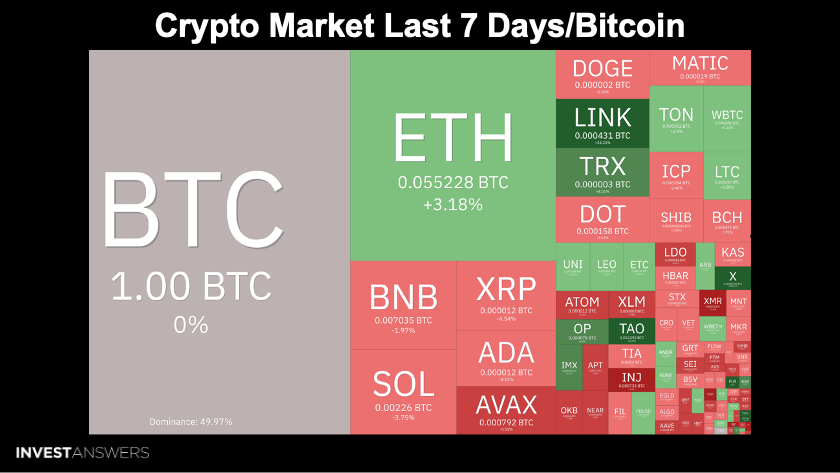

Crypto Market Update:

The global crypto market cap is $1.65 trillion, with a 24-hour volume of $42.69 billion.

The price of Bitcoin is $43,181.82, and BTC market dominance is 51.3%.

The price of Ethereum is $2,339.21, and ETH market dominance is 17.0%.

The best-performing sector is AI, which gained 5%.

The Crypto Fear & Greed Index is currently Greed (64).

The Oracles were in the sunshine this week as LINK, PITH, TAO, and X all performed strongly against Bitcoin. Even Ethereum beat Bitcoin by 3%.

BTC was flat

LINK, PYTH, and TAO are all north of 20%

AVAX, ATOM, XLM, XMR, and XRP were dark red

Digital asset investment products saw large inflows totaling $708M last week, bringing year-to-date inflows to $1.6B and total global assets under management to $53B. These funds are going to grow to be a lot bigger.

I had a fairly aggressive ETF target that $50 billion could flow into the fund throughout 2024. According to the current trend, the forecast is very close to the money. This means that the assets under management will double by year-end.

Bitcoin +$702.7M

Ethereum -$6M

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.