Today’s Nuggets

Lawfare Not Dead

France is Fudged

Kimchi Premium & Korean Madness

We Need Bots

Bitcoin Asymmetric Bet of 2024

New Pro Crypto SEC Chair

The Coinbase Drain

Tether Grows 11.11% in 30 Days

Bitcoin the New Oil?

MSTR Yield Popping Off

Tesla China is On Fire

SpaceX Domination

The world and the crypto market are in chaos!

Weird stuff is happening behind the scenes and we will try to break it all down to understand the connective tissue between this complex space in which we live so that we can survive better.

The crypto market cap is $3.45 trillion. Bitcoin is now at $95,771 and its dominance is down to 55%. The Fear and Greed Index is at 76%.

Things are still pumping!

Unfortunately, there is quite a bit of ugly news so brace yourselves.

We have some common names here:

JITO is a Solana-based token with nearly half a billion dollars in unlock, which is nuts;

Avalanche is showing up this week;

Cardano, Sei, and Sui are all side by side;

ENA will rain down tokens forever; and

Wormhole, Arbitrum, Fetch, Zeta, and DYDX are the usual suspects.

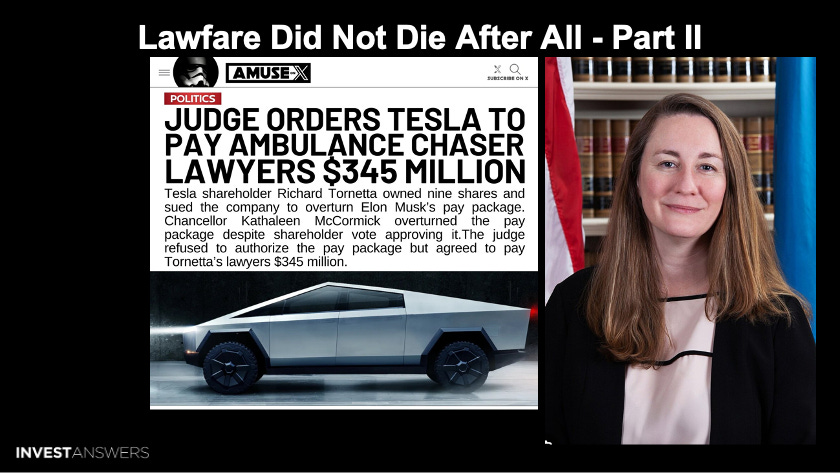

Everybody seems to be going after Elon Musk.

Not only have the Governor of California but now we have people like this.

These judges’ only job is to uphold the law, not be criminals, and fail to punish their enemies using lawfare.

I will not give too much oxygen to this story, but the legal system's corruption is stunning.

I hope that it is all cut out.

There was talk of some U.S. government candidates doing the same thing in taxing unrealized gains.

Nothing is more nonsensical than punishing people who own crypto by going after unrealized capital gains. Do the French government representatives not know that people with crypto will take it and go to Dubai or Portugal?

When a government or a state goes after the wealthy, the wealthy leave.

Look at the French stock market performance versus the U.S. stocks. It is tanking and this period is just over a few months.

France's stock index benchmark is trailing its Eurozone peers and the Euro markets have been destroyed in Germany and other places. However, compared to the S&P 500, French stocks have underperformed by a mind-boggling 31%.

France is experiencing unprecedented budget deficits caused by aging, social benefits, health care, immigration, climate controls, poor policies, a terrible bond market, a terrible capital market, too much regulation, and too much debt.

This list applies to many countries in the world. France is a microcosm of what is happening in the UK, Germany, the U.S., and Canada. The same set of problems are being faced by governments worldwide.

For a long time, I have been talking about how industrial combustion engine (ICE) car makers will die.

A recent report from Bloomberg indicates that they are dying sooner than I expected.

Mercedes, BMW, Volkswagen, Stellantis, and Renault (French company) are all on the decline. The European automotive sector is facing a serious crisis, and demand for cars is tanking. It will never return to pre-pandemic levels but they have tons of factories with lots of capacity. European exports are going dark, especially with threats of U.S. tariffs.

Of course, then there is China. Mercedes sells half of its cars in China, which has dried up in just one year. It is shocking to see what is happening but it was pretty easy to forecast this trend.

This is the South Korean stock market compared to the XRP volume on Upbit.

XRP volume on Upbit Global did more volume than the entire Korean stock exchange. Not only is crypto adoption going through the moon but weird things are happening simultaneously.

Then, in the last 12 or 24 hours, Korea declared martial law and a bunch of other craziness. Governments are losing control and they do not like it.

Why do we not roll some tanks through the street to stop it? One thing I am sure of is

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.