NUGGETS OF ALPHA

ARM is anticipated to be the most valuable company to go public since Rivian

ARM produces embedded systems focusing on CPUs primarily for mobile devices

ARM is a semiconductor company specializing in designing ARM-based processors

ARM's installed base is increasing, with 258 billion chips shipped through 2022

ARM is presently valued at 89 times earnings compared to NVDA's 32x

Apple has a long history of using ARM architecture in various products

TSMC produces Apple's ARM processors

There is a resurgence in an open-source competitor to ARM—RISC-V

Chinese chip design houses are exploring alternative solutions using RISC-V

The future is AI and no longer embedded systems (becoming commoditized)

The IA Patreon community voted for this study instead of a Face Off - a whopping 1,000+ votes were submitted.

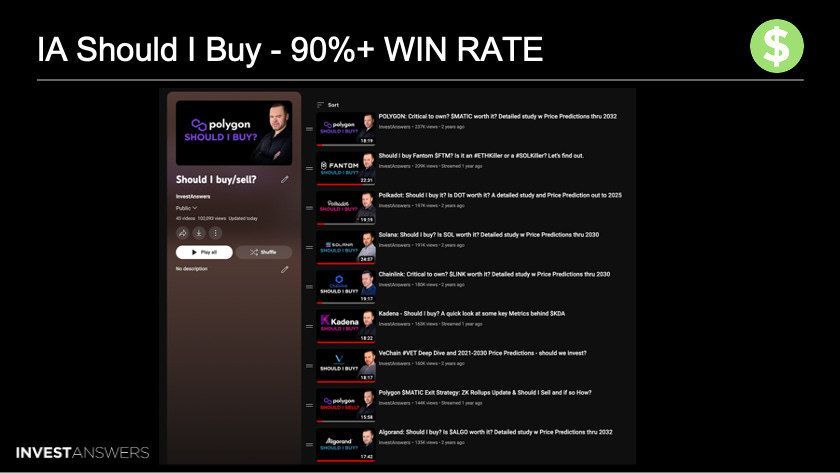

When investing, I am very picky. I buy very few things. My channel is all about alpha. I do not get married to any one asset. My ‘Should I Buy” series has experienced more than a 92% win rate over its history.

The last IPO analysis I conducted was Coinbase on April 14, 2021.

We have a detailed valuation process for equities, just as we do for crypto. We will touch on many financials today, with my price predictions at the end.

Arm Holdings Ltd, the chip designer owned by SoftBank Group Corp, is set to launch its initial public offering next week, with plans to seek a share price in the range of $47 to $51, according to sources familiar with the matter. This pricing range, not previously disclosed, would result in an Arm valuation estimated at approximately $50 billion to $54 billion, with an IPO raising between $5 billion and $5.4 billion.

If successful, this IPO would make ARM

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.