Today’s Nuggets

Final Dip before the Halving?

Fed Winning the War on Inflation?

Tesla Off to a Rough Start

The 60/40 Portfolio is Still Dying

De-risking in Response to Conflict

Ethereum Crushed by Bitcoin

Global Liquidity Declining

Mr100 Doubles ARK Invest?

Solana Dominating in Daily Active Users

Solana Whales Feast on Memecoins

Massive Airdrops for Saga

U.S. New Housing Developments Collapsed

U.S. Producing More Oil Than Any Country in History?

Time to Buy or Sell?

Every week, OCTA serves as a comprehensive tour of all things finance, including crypto, macro, on-chain, charts, etc. In addition, I will share the good, bad, and ugly news from the last week.

I know the markets are hard out there but I did not think I would get the chance to buy into certain names at these prices ever again. So, I see this as a gift!

Over the last six months, we saw the most incredible gains in some altcoins - mindblowing stuff. However, much of that has been erased in the last one to two weeks for numerous reasons: macro, Fed, war, congestion, etc. We will review much of this today as well.

Crypto Market Update:

The global crypto market cap is $2.25 trillion, with a 24-hour volume of $113.32 billion.

The price of Bitcoin is $61,914.69 and BTC market dominance is 54.2%.

The price of Ethereum is $3,017.71.

The Crypto Fear & Greed Index is currently Greed (65).

Who cares.

If you look at Jerome Powell's face, it is obvious that the Fed is not winning the war on inflation.

Powell stated that despite the economy performing "fairly strong," the latest data shows no further progress on inflation has been made this year. Twelve-month core inflation changed little in March compared to forecasts. While the Fed took a cautious approach to avoid overreacting to last year's declines, recent data did not inspire any confidence. Therefore, they say that time is needed for further policy work with these rates, which are taking the U.S. interest on debt to $2T and the deficits are exploding!

As I have always said, the Fed does not control inflation!

40% of inflation is driven by oil…

Do they control the price of oil? No!

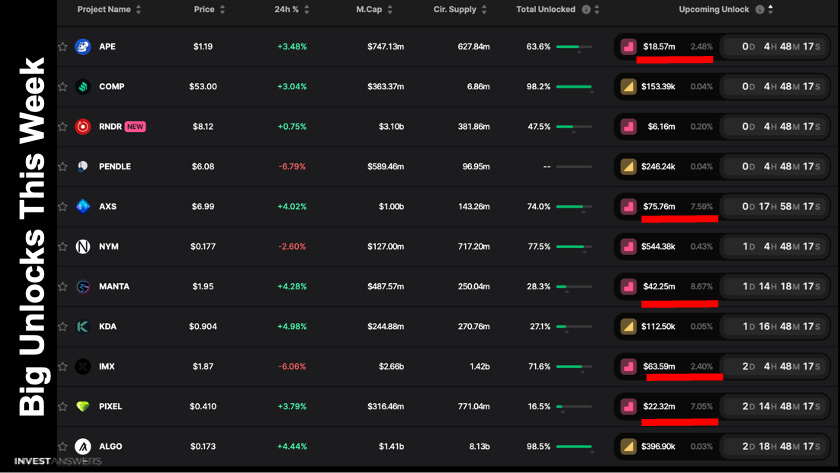

Let's review the big unlocks coming this week:

APE just rains coins all the time and other unlocks every week

RNDR has a tiny 2% unlock that is not too worrisome

AXS, 7.6% unlock

MANTA, 9% unlock

IMX, 2.4%

PIXEL, 7.05%

I have been calling tokens like Axie garbage for the longest time, yet their holders get really upset when you reveal the data…

Our ATR model took us a year and a half to build and it has a ton of technology designed to identify zombies. This tool was designed to help you quickly determine where you are in the macro sequence compared to other assets.

Using the ATR model, it is easy to see that Axie Infinity is a cash grab, as it remains at level zero after one and a half years into a bull market.

ApeCoin is a complete zombie. I have been making fun of it for a long time. It has fallen over 30 to 50% over the last seven days and is down 75% since last April.

I do not touch NFTs or memes for a reason. They are lethal and even the best assets in the world can rip your face off!

Be careful as markets are tough out there…

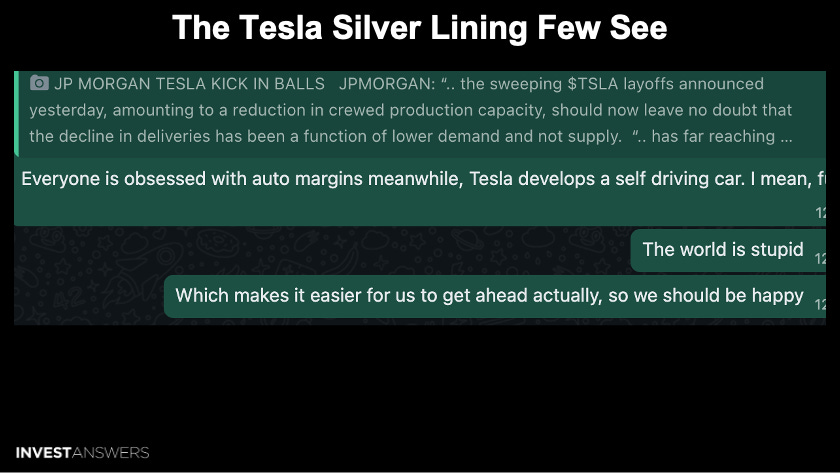

Now let's discuss what I believe to be the best company on the planet by far.

It does not bother me that Tesla's stock is weak right now because I know it will not be, one day. Markets can be completely irrational.

Tesla is so far ahead, it is not even funny…

The silver lining in Tesla's stock performance is that it makes it easier for us to get ahead.

Only three and a half years ago, Tesla was at $400 and the company has way more value than I ever imagined possible at its $160 stock price.

We are getting a second bite at the apple!

The 60/40 portfolio last performed this poorly back in the year 1930! Are bonds still your thing?

The main point is that

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.