NUGGETS OF ALPHA

Cryptocurrency Dynamics upcoming halvings and ETFs.

Digital asset fund flows are over $5.2B YTD, with $2.5B last week

The BTC ETFs achieved in a month what gold took a year to do

Bitcoin reserves on Coinbase are now at an eight-year low

Chainlink exec stated that leading banks have begun tokenizing real-world assets

Total money-market fund assets have exceeded $6 trillion

Market Trends and Nvidia's upcoming earnings set the trend for the AI market

Global Liquidity and Consumer Behavior updates

Wage Growth and Housing Market

Technological and Financial Innovations

The stock market was weak, and big tech got hammered:

TSLA +2%

AMZN -3%

GOOG -4%

MSFT -3.34%

AAPL -3.38%

What NVIDIA does after reporting earnings, the whole AI market will follow. There is endless demand for NVDA products and we are still early in this AI revolution.

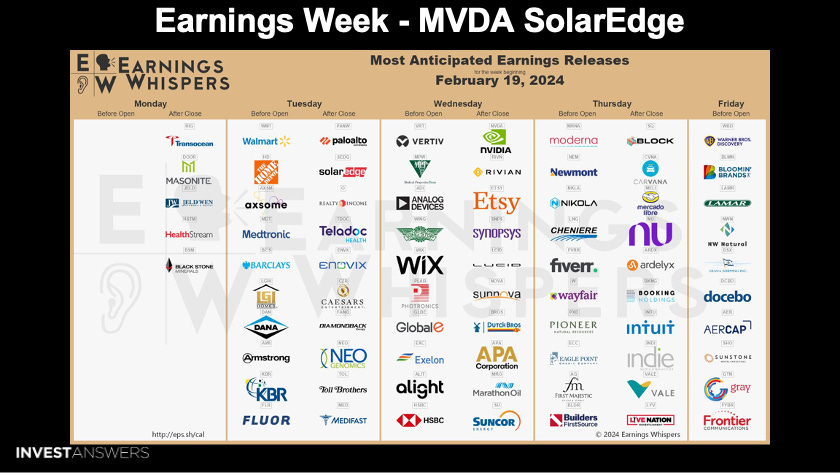

I am tracking Solar Edge because of my position in Enphase. The last time Solar Edge dipped in earnings, Enphase stock went down with it.

Global Liquidity has yet to skyrocket, as it has been down for most of 2024. However, the liquidity is going to come soon.

Walmart is a USA retailer where Americans get bargains. Walmart's same-store sales jumped 4.0% in the quarter, compared with Bloomberg consensus estimates of 3.12%. The rise was driven by more shoppers going to the store more frequently, but a slight drop in average tickets signaled they added less to their basket.

People going to Walmart instead of a higher-priced store like Whole Foods means they are hunting discounts and buying less. This implies consumers have less money, which is my classic crude recession indicator.

Wage growth is down 7% to 5%. Those of you who work for a living: make sure you

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.