Today’s Nuggets

September is Only Negative 44% of the Time

Historic EU Debt Incoming

The Key to Bitcoin Price Stability

iPhone Cost in Bitcoin Terms

Saylor Shocks CNBS

Helium’s Defiant Performance

VanEck Shuttering ETH Futures ETF

Coinbase’s BASE Crushing ETH L2’s

Zeus Network Addressing Bitcoin’s Needs

Going Back to ZIRP

In this OCTA, we will cover some crazy statistics happening in different parts of the world from macro and crypto perspectives.

Crypto Market Update:

The crypto market cap is back over $2 trillion;

Bitcoin is now above $57,500, with a long way to go back to the roof of $73,800. We are back up to the floor but still off the 200-day moving average but not too bad; and

The Fear and Greed index is back at 33, which is also a positive sign and indicates that people are feeling a little more confident about entering the market again.

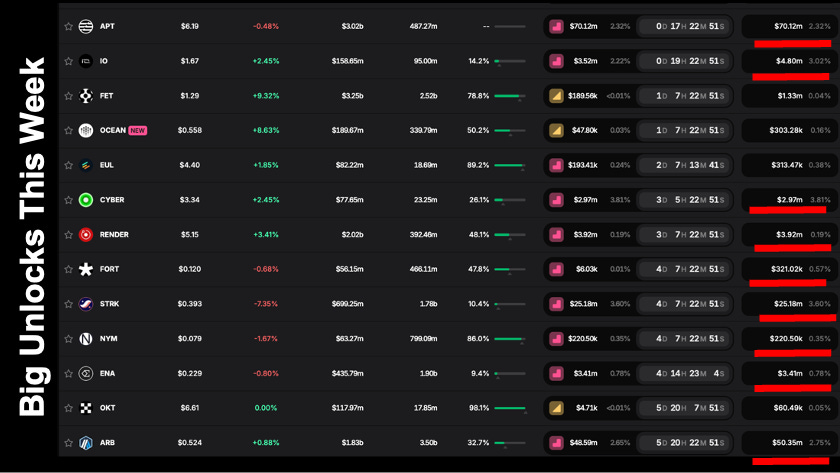

APT = $70 million unlock.

CYBER is always there.

RENDER is only a 0.19% unlock at $3.9 million, which is nothing burger.

STRK = 3.6% unlock.

ARB = $50 million unlock.

According to the team at CoinShares, digital asset investment products experienced significant outflows last week.

There was a big dip comparable to levels experienced in March on Week 11. The March sell-off happened right after we hit the top and we had another bad one last week.

This is cool from Charlie Bilello to give people hope…

September is typically the worst month of the year for both the stock market and crypto. We may have had that early dip already but we know what is coming.

The rate cut will be in about six days or so.

There were two big bright spots last week: Oracle and Tesla, featured in bright green.

Oracle is going big into the AI space as well. Larry Ellison is an investor in Telsa and a big friend of Elon Musk, and the two are also doing stuff around data centers. Amazon was up 2.38%, and the rest of tech was down.

The European Central Bank president Mario Draghi called on the EU to invest as much as $800 billion combined with regular issuance of common bonds to compete with China and the United States.

We are falling way behind and need to boost investment by about five percentage points of the Eurozone's GDP.

This would reflect spending amounts we have not seen since World War II. Draghi also pitched the adoption of the EU's competition policy so it does not become a barrier to the bloc's industrial goals.

The U.S. GDP is up to $35 trillion. China recently surpassed the EU's $25 trillion GDP. Notice that the European Union is not growing and feels like it is falling behind.

GDP has to grow because money will grow, money printing will happen and so will debasement.

This stimulus from the EU could be great!

All these countries work because if one prints and debases, the others do as well. It becomes like a nuclear arms race to print as much fiat as possible to make yourself competitive.

Watching it will be fun because we are in hard assets and like it!

https://www.investor-profiler.investanswers.io

Over 8,000 people have completed their investor profiler. This helps you identify who you are, the legendary investor you are like, and what your blind spot is so you can fix it.

These tokens beat Bitcoin this week: ETH beat BTC, SOL, XRP, TON, DOGE, etc.

BNB, TRX, AVAX, DOT, and LEO all had a bad week.

There was a lot of green across the board last week.

People lost their minds last week but most of the damage was done about eight days ago.

Most of the crypto is slowly creeping back up.

The Fear and Greed is also creeping up slowly, back to 33. We fell down to the low 20s for a few days there and are now back up.

This is a chart from @cryptoquant_com that shows you what is referred to as the shifting hands as BTC flows from the weak hands to the strong holders. If you look carefully, you will see increased accumulation by long-term holders, which will help lead to price stabilization and position the market for a potential rebound from the short-term holder sell-offs. The long-term holders are now back in control, as indicated by the green spike representing the positive daily difference over the last 30 days' moving average.

This is another view from @cryptoquant_com of how long-term holders are key to price stability. You can see here that long-term holders are more in control. Short-term holders have fallen to only about 17.5% of the total amount right now. Even though the axis on the right only goes down as low as 70%, now 83% of the holders of Bitcoin are long-term holders (more than 155 days). So basically, we're at the point of seller exhaustion, which is good.

This is another cool chart from @cryptoquant_com, and according to Axel, the secret gnome is BlackRock. We have not had major dips like in previous cycles, which is exciting. Every time there is a dip, the whales come in and buy. Once we get to the $67,000 to $70,000, they are being sold off again. The whales know $58K is a very good price.

In real terms, we have not hit the all-time high yet because of

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.