Today’s Nuggets

Marathon Now HODL’s 26,200

Tether is More Profitable than BlackRock?

Corrupt Government Hiring Practices

BlackRock’s Statement on the Hedge Against Trust in Governments

OTC Cupboard No Longer Bare

BTC versus Net U.S. Liquidity in Lockstep

Tale of Two Cities

Stage Set for a Wild 2025

Stablecoins Surging in Singapore

This "75% Allocation" story seeks to answer the question of what constitutes a prudent allocation to Bitcoin.

In addition, we are going to discuss the Bitcoin miners and various other assets and cover a whole bunch of ratios.

I will also introduce a new section entitled: "Good Charts, Bad Charts."

The Fear & Greed Index was down to 31.

People are still not quite sure where the market is going just yet.

You simply cannot stop progress and you cannot kill Bitcoin.

Welcome in, Jamie Dimon and JPMorgan.

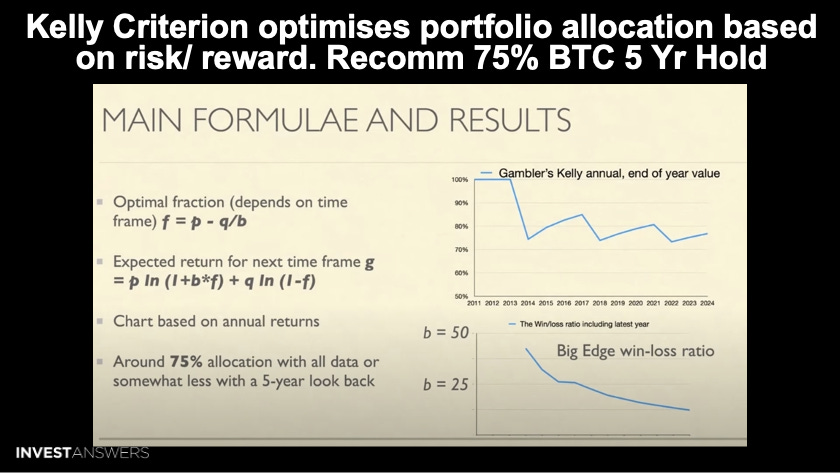

First of all, I want to explain some methodology around optimal allocation based on history.

The Kelly Criterion also looks at risk-reward, which I always talk about. This is key to allocations, and allocations matter in investing. The Kelly criterion takes into account the potential returns, reward, and probability of success risk for each investment option.

Over the past several years, Bitcoin has shown high returns but also very high volatility. Because of its strong performance, the Kelly Criterion formula suggests a 75% allocation to Bitcoin over a five-year period. The key here is that

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.