Today’s Nuggets

Tech Sell Off Hits Crypto

Jersey City Pension Investing in BTC

Russia to Legalize Mining & Crypto Payments

The Latest VanEck Prediction

MARA Purchases 20,000 BTC

Most Secure Email Adds Bitcoin Wallet

Historical Golden Cross Incoming

Leveraged Long Hunting Opportunity

Let us begin with an analogy: Imagine owning a chocolate factory and then going out to stores and buying chocolate. Well… we have one of those situations.

We have pension funds jumping in. We got a crazy price target from VanEck, which I will analyze a bit for you. We have a radical move in one of our indicators. We are also going to analyze all of the latest minor production products.

Crypto Market Update:

The global crypto market cap is lower at $2.32 trillion.

The Crypto Fear & Greed Index is now at 68.

Firstly, there has been a massive tech sell-off.

The Nasdaq fell ~3.6%, having had its worst day in two years. The S&P is down 2.3%, Bitcoin fell over 3%, and Ethereum dropped over 8%.

The state of Wisconsin pension fund jumped with its 13F filings in Q1.

Mayor Stephen Fullop announced that the Jersey City Pension Fund is updating paperwork with the SEC to allocate a portion of their pension fund, about 2%, to Bitcoin. This is a classic example of slowly but suddenly transpiring. Every time I see things like this, I want to refresh myself and you all about how big pensions are.

The size of global pension funds is $76.3 trillion. The expectation is that it will reach nearly $120 trillion in five years, which is massive.

Some of the biggest funds are CalPERS, the Japanese pension funds, and the Norwegian sovereign funds. The fastest-growing pension funds are also in Australia and New Zealand, with the largest markets in Japan and North America.

$76.3 trillion is nearly 60 times the Bitcoin market cap. If these pension funds were to allocate a tiny bit, it would blow Bitcoin to the moon.

The question is, when will the game theory kick in?

Pension funds have experienced a 9.43% compound annual growth rate or 57% over five years.

The pension funds have to grow.

You are not treading water if you are not growing your bags at 14%. Therefore, they need to allocate to the apex predator, which is Bitcoin.

This is a big move for Russia.

To be honest, I think the Ruskies on the ground have been using Bitcoin anyway because you cannot stop it. Also, there is a lot of Bitcoin mining happening in Russia despite the fact that it is banned. If you have access to some free electricity, combined with a couple of rigs, you plug them in. Nobody knows the better.

Anyway, another domino falls here.

RFK made this very interesting statement at the Bitcoin Conference. He must have seen my treasury video about ten days ago, in which I compared two different scenarios.

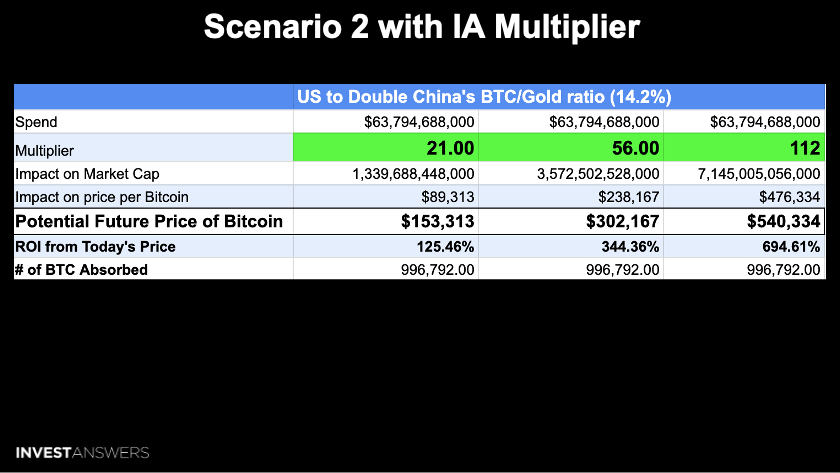

As a reminder, using just a very conservative IA multiplier, if it were to happen, would take the Bitcoin price to about $540,000.

Again, this is just an allocation by the US government to double the percentage that China has in terms of gold as a reserve asset.

In a recent report, the team at VanEck provided some heavy-duty speculation and they know their stuff.

VanEck's models based on global adoption, medium of exchange, and trade integration produced a very ambitious price projection for Bitcoin.

This is VanEck's price prediction chart. I want to show you a couple of things that I think I have got a problem with. One, your price per Bitcoin base case is $2.9 million. Remember, the dollar will debase a truckload by 2050. A million dollars today will be worth about $400,000 in purchasing power in 10 years.

The total trade in Bitcoin is the same but the percentage of Bitcoin in circulation differs. The expected case means

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.