NUGGETS OF ALPHA

Layering in and layering out of the market is essential for investing well

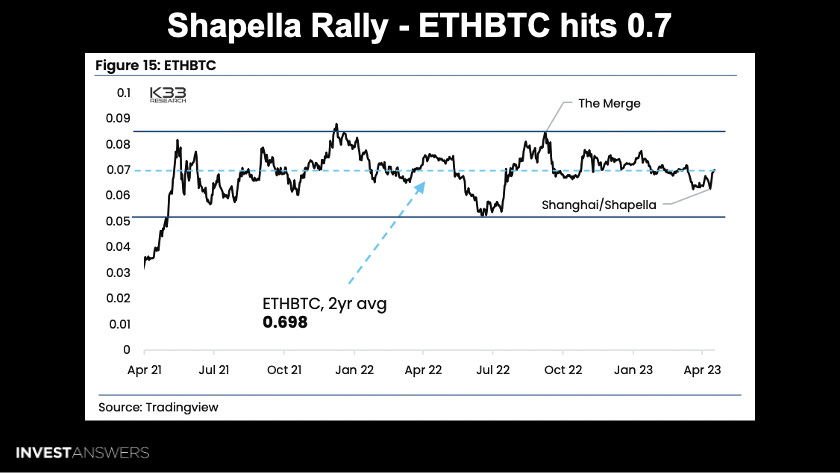

Ethereum rose 7.17% against BTC over the last 7 days

Bitcoin recovered at a much faster pace than the previous two cycles in 2017 & 2021

If history repeats, Bitcoin price will peak around May 20 at ~$45K

Ethereum’s Shapella upgrade was a buy-the-news event exaggerating the impact of this known event

Daily active addresses on Polygon, Ethereum and Solana are converging this week

Digital asset investment products saw inflows totaling $114M last week, with ~$345M this month

$103.8M flowed into Bitcoin over the last 7 days

The Bitcoin put/call ratio is 0.28, slightly more bearish than last week’s 0.26

The Ethereum pul/call ratio is 0.39, with a target price of $2.4-2.7K by end of May

Tesla outperforming major Chinese EV makers year to date

Tesla’s pricing on the Model 3 & Y is beyond parity with ICE manufacturers

Crypto Fear & Greed Index is falling fast, expect some money outflow this week

US wages beginning to exceed the inflation rate for the first time in two years

The dollar’s dominance as a reserve currency continues to erode at 10 times the pace seen in the past 2 decades

The half-life of the US dollar is now 10.47 years

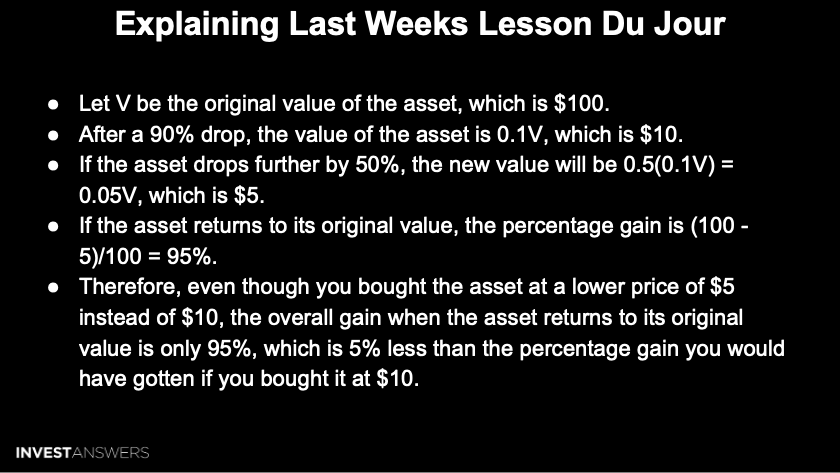

This slide confused so many people last week, so I am going to spell this out:

In other words, even though you could buy the asset at a lower price, the overall gain when the investment returns to its original value is not as significant as you may have thought. I find people sometimes get so much PTSD from the bear market that they want to wait, wait, and wait before jumping back in. This is why we always encourage layering in and layering out of the market.

Ethereum returned this week, rising 7.17% against BTC.

This week, SOL, AVAX, ICP, LINK, OKB, and ARB significantly outperformed BTC.

After a violent swing down, Bitcoin swung right back up to over $30K, Ethereum is firmly above $2K, and the rest of the market is trending up.

We discussed on DCA this week how the many seem to rotate amongst the top cryptos. If you are a swing trader or scalper, you need to know where the bees will go to be profitable.

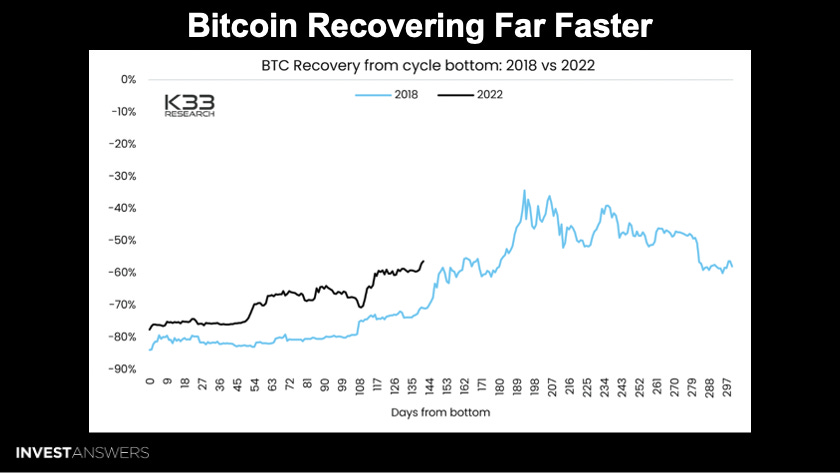

Per K33 Research, these three cycles' bottoms lasted approximately 370 days. The cycle we are presently in is recovering much faster than the previous two.

The Bitcoin market sits in an interesting position, whereby our Long/Short-Term Holder threshold of 155 days is approximately when FTX imploded.

As such, we can interpret LTH and STH metrics as follows:

🟦 Long-Term Holders acquired coins before FTX failed and currently hold a total supply balance of 14.161M BTC, which is just shy of a new ATH.

🟥 Short-Term Holders acquired coins after FTX failed and have seen their supply balance of 2.914M BTC remain relatively constant in 2023.

The early 2023 rally has all the hallmarks of a hated rally. Many new entrants have entered the market, while many previous-generation crypto investors are waiting over on the sidelines. Bitcoin has recovered at a much faster pace than the previous bear market.

If history repeats, BTC will peak around May 20 at $45,000. The current BTC price cycle is remarkably similar to previous cycles. The committed long-term holders are still unwilling to sell at a 60% drawdown making, resulting in much less supply available this cycle. Big money, such as Bank of America and National Bank of Canada, is coming into the space for the first time.

We are at the time frame from the bottom left all over again when the next Bitcoin halving takes place in ~1 year. You’ll notice the price gradually goes up from here. People will try to front-run the halving because the world is much better educated.

The Ethereum Shanghai upgrade (also called Shapella) was, in typical fashion, a buy-the-news event, where the market yet again exaggerated the impact of a known event. Shanghai launched on the mainnet on Wednesday, followed by a sharp rally in Ether, as the ETH:BTC reclaimed 0.07.

Ethereum had underperformed versus BTC throughout the year, likely motivated by expected selling pressure following Shanghai.

While more than 1 million ETH has been withdrawn from staking, the price has thrived. The withdrawal volume has been substantial in the first week. Still, the ETH price experienced a fruitful rally, suggesting that the selling pressure has been far more muted than anticipated.

899,803 staked ETH tokens are waiting to be unstacked. That is ~5% of all the ETH 2.0 validators. 80% coming from three places Kraken, Binance, and Coinbase.

The daily active addresses on Ethereum have cooled down a bit this week.

Digital asset investment products saw inflows totaling $114M last week, which is seeing continued improving sentiment for the asset class. This 4-week run of inflows now totals $345M.

Despite the successful launch of Ethereum’s yield features (i.e., Shapella), only $0.3M of inflows were seen last week. Minimal activity is observable in the altcoins except for SOL, which saw $2.1M of outflows last week. Blockchain equities saw inflows of $5.8M. Recent price appreciation has pushed total assets under management to $1.9bn, the highest since October 2022.

Big money continues to flow into Bitcoin, with $103.8M this week.

Note that this is an OTC product not regulated by the SEC. Grayscale Solana Trust is designed to provide investors with exposure to SOL, the native token of the Solana blockchain. If people still trust Grayscale, it should drive more inflows into Solana.

This should drive an increase in daily active users.

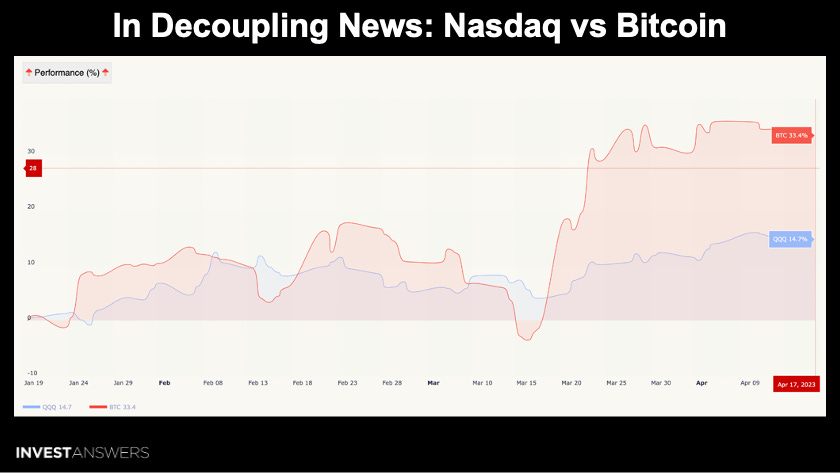

Over the last 90-day period, BTC is up 33.4%, and QQQ is up 14.7%.

We moved up from 14 last week to 16 today, so Bitcoin is still outperforming the majority of the altcoins.

This was a mixed week for equities performance. Chinese stocks fell hard. GOOG and TSLA was down. However, the other names we follow closely were up:

AAPL

AMZN

MSFT

NVDA

META

The put/call ratio is 0.28, up from last week’s 0.26. This indicates a slightly more bearish sentiment in the market.

The max pain moved from $24K to $27K this week, or the point where people stand to lose the most amount of money.

This week, the max pain price moved from $1.6K to $1.8K. Large bets are being made that Ethereum could land between $2.4-2.7K by the end of May.

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.