NUGGETS OF ALPHA

As we predicted in early May, the "Sell in May, and Go Away" strategy does not work

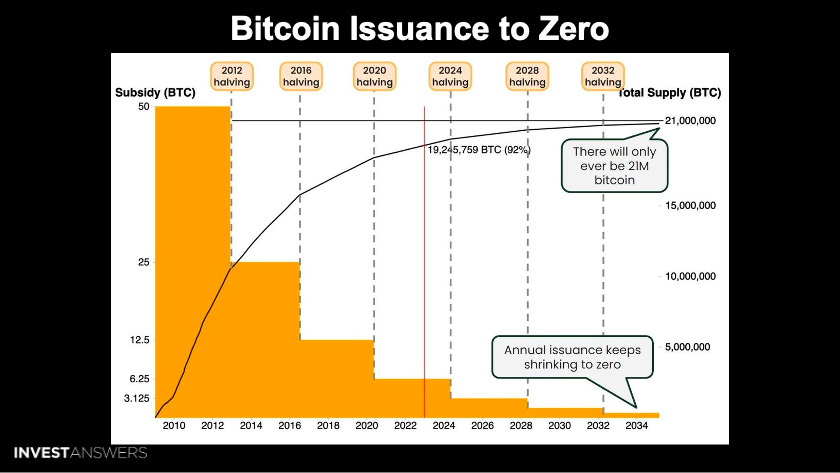

Due to scarcity and supply schedule Bitcoin is a singularly unique digital asset

"There is no next Bitcoin" or alternative digital savings technology

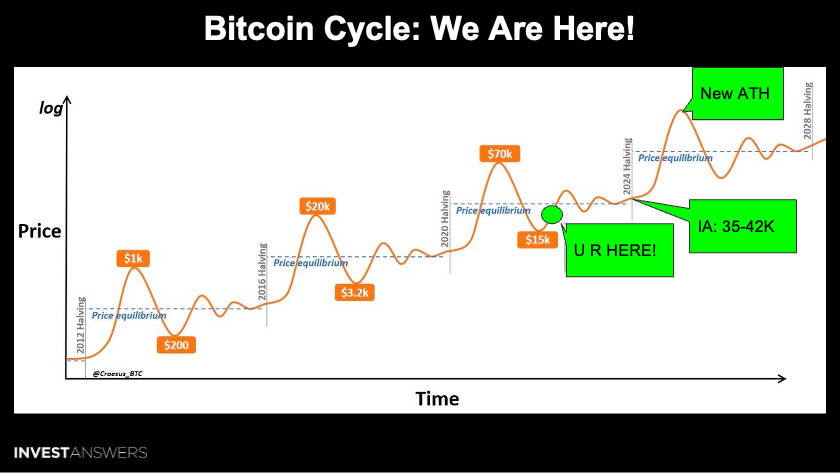

BTC could be between $35-42K before the next halving (~April 14, 2024)

< 100 BTC wallets keep buying at a rate of 248% of the BTC minted by miners

As of June 13, 2023, the BTC supply held longer than one year is at an ATH of 68%

Bitcoin sentiment at its lowest reading since March 2020

Investor sentiment improving as the headline index gains 20%

Treasury refilling its TGA coffers ($4T+) is a key bullish narrative

Thursday the European Central Bank raised rates to 3.5% (highest in 22 years)

Inflation in the UK and ECB is still far higher than the US

All signs point towards the economy shrinking across the US and Europe

So much for “Sell in May, and Go Away,” it certainly did not work as predicted! Too many other catalysts fueling the market upwards like money printing, fed pause, AI narrative etc.

In this lesson we will review 21 charts to determine if the bulls are indeed awakening in the market.

Here is where we are with the Bitcoin cycle as annual insurance keeps shrinking to zero over time. To reach an issuance of zero requires a coin to have a supply schedule of increasing scarcity. These mechanics are written in stone in the protocol and nobody can change it.

There will only ever be 14M Bitcoin in supply per our analysis due to lost coins. This makes Bitcoin a singularly unique asset in the digital asset landscape and we are not the only ones that have recognized this phenomenon.

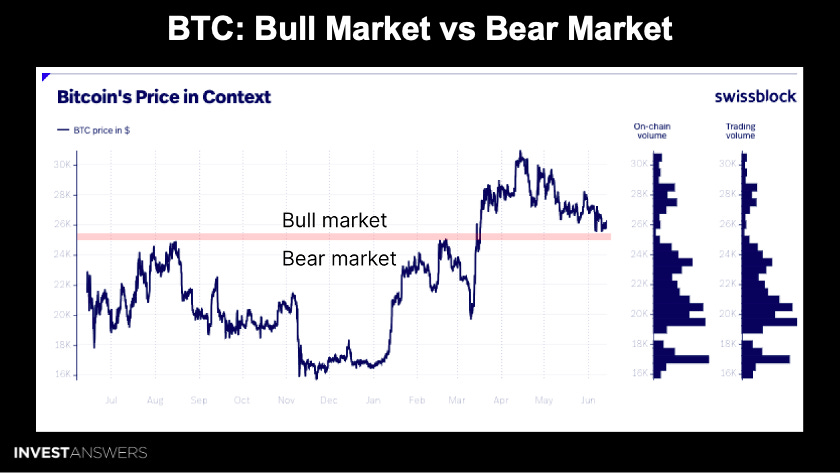

This chart shows you a timeline of where the 2024 halving is in the lifecycle of Bitcoin. We see the bottom was at ~$15.5K level, and now we are at the green dot hovering above the $25K level.

Per my estimates, BTC could be between $35-42K before the next halving or April 14, 2024. When the demand is greater because of the halving, the price goes up. The new all-time high should arrive within six months of the halving or 480 days from now.

"There is no next Bitcoin" or alternative digital savings technology such as this. However, keep your seat belts on because it will be a volatile period ahead.

Bitcoin's price is at a critical juncture, hovering around the

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.