Let’s see how my 2023 predictions (which I forecasted at the end of 2022) ended up - was I mostly right or mostly wrong? Each year I find it essential to scrutinize my forecasts closely.

In 2023, I went against the grain. Everybody was predicting doom and gloom, forecasting a horrible recession and a stock market crash worse than the dot-com bust. They were all completely wrong.

If the consensus is in one direction, you will probably be right by going down the opposite path.

This slide outlines the way I score myself:

If I'm right, I get a green check.

If I'm half right, I get a half a score.

If I'm wrong, I get a red X.

I was correct!

This chart is from the IA Bitcoin Top & Bottom (TABI) model, indicating that the early bully run began on January 14th, 2023. The full bull started when it turned yellow in late 2023.

The first prediction was important because I got into heavy positions in things like Bitcoin miners and MicroStrategy. I knew we were going into a bull market and that it would hit earlier than expected. This illustrates that you must be in your position before the market reacts to experience exceptional performance—"get in early, get in hard."

Core Scientific went bankrupt, and a couple of others had to issue a lot of stock to pay off debt.

On-chain Real World Assets ("RWAs") presented a massive opportunity and experienced significant development in 2023.

This prediction was due to Ethereum migrating to a proof of stake consensus mechanism.

I was wrong by 11 days but still awarded myself a point for this prediction.

The Next Big Thing was rumored to be Decentralized Social Media in Web 3. However, apps like Mastodon did not take off in 2023.

This all began to happen in 2023. Jupiter (jup.ag) is a good example, where I can do all my crypto trading.

We ain't seen nothing yet!

I missed this one as I thought DEX volume would explode to new all-time highs in 2023, breaking that $213 billion record volume.

You can see here that we got nowhere near record volumes, but a lot of change is happening with DEXs. Centralized exchanges did become less popular. During a few periods in 2023, Uniswap beat out Coinbase in overall volume.

In 2023, the Proof of Reserves (PoR) trend gained significant momentum in the cryptocurrency world, especially after the collapse of FTX. A number of centralized exchanges started to publish their Proof of Reserves to restore trust in the platforms and reassure users that their funds were safe.

Instead, the U.S. government went after Binance, and that all fizzled out.

In 2023, DeFi insurance experienced significant growth, with the total value locked (TVL) reaching $53.30 billion, a notable 39% increase from the previous year's $33.9 billion. This growth can be attributed to the increasing demand for decentralized finance and the need for insurance coverage in the crypto space. Several DeFi insurance protocols, such as CheckDot, demonstrated strong performance despite the bear market.

The quality of the games is improving. Some games now utilize stablecoins for in-game purchases and transactions, linking traditional and web3 gaming. 2023 saw the rise of interoperability in web3 gaming, allowing players to use digital assets across multiple games and fostering an open gaming ecosystem.

In the United States, the Stablecoin TRUST Act was introduced by Senator Pat Toomey, which aimed to establish a comprehensive regulatory framework for the payment of stablecoins and guide Congress toward sensible regulation of cryptocurrencies.

In Europe, the European Central Bank (ECB) and other regulatory bodies continued to work on the Markets in Crypto-assets (MiCA) Regulation, which would provide a harmonized framework for the regulation of crypto-assets, including stablecoins. The ECB also released a report on stablecoins, highlighting their functions, risks, and the need for appropriate regulatory, supervisory, and oversight frameworks.

Today, people are beginning to focus on daily active users, money flow, and developers. The space is becoming much more sophisticated.

The 1-year inflation expectations in the United States also dipped to a near three-year low of 3.1% in December 2023, according to a final reading of the University of Michigan's consumer sentiment survey. This indicated that consumers were becoming more confident in the Federal Reserve's ability to manage inflation.

Apparently, 18 of the 50 states in the United States did have a recession; however, this was not the entire country. So, I missed this one.

The Fed paused in June. In July, they did one more hike and then finished the year with three consecutive pauses.

The Fed did not cut rates but paused four times over the second half of 2023.

I was correct about the stock market rising.

This was a bold call at the time, but the S&P is hovering around $4,783, near an all-time high.

It has been a crazy good year for the NASDAQ and, in particular, the Magnificent 7.

Charlie Bilello supplied a nice chart demonstrating how growth outperformed value in 2023. Here, you can see the top 10 growth stocks as a weighting of the S&P 500 hit an all-time high, meaning there is a massive concentration of value in such companies.

Tesla indeed rebounded well.

Tesla experienced a great year - you could have bought it at $108 at the beginning of the year, and now it is hovering around $250.

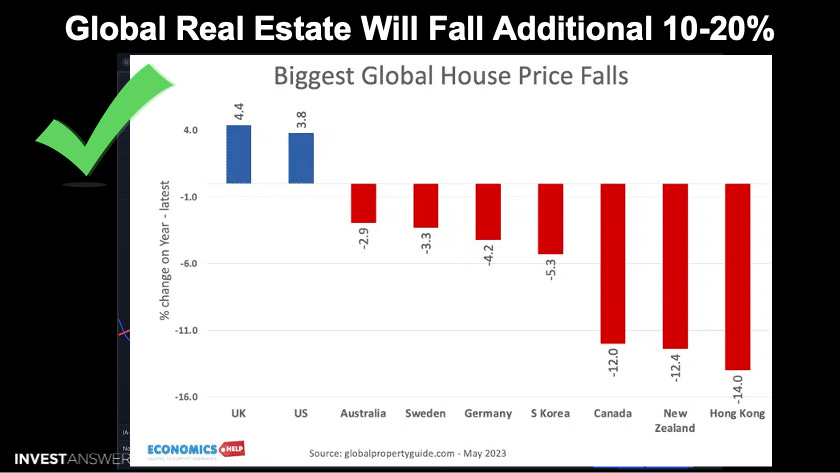

Real estate values are hard to paint with a broad brush. The valuations depend on where you are in the world.

Real estate apparently increased in value in the United States and the United Kingdom. However, real estate got hit really hard in places like Canada, New Zealand, and Hong Kong. Real estate should rebound and get better in 2024.

I got this one wrong.

As of today, the spread is still 276 basis points. This one will probably happen in 2024.

In 2023, there were indeed more strikes and riots than in previous years, particularly when compared to the past two decades. According to the Office for National Statistics, the number of days lost to strike action in the UK in December 2023 was 843,000. This increase in strike activity is also reflected in the United States, where over 300 strikes occurred, involving more than 450,000 workers.

Sadly, I expect this worsen as a lot of change happens in the world.

This prediction was more from a hopium perspective, and unfortunately, I got this one wrong as well.

I always aim to be Pareto efficient, and the 2023 predictions were in line with this performance. The point is that if you get 75-80% correct and allocate accordingly in the market, you can do exceptionally well.