Today’s Nuggets

The ETHE Dump Begins

Companies with the Most Cash on Hand

Dems Pass on Bitcoin Conference

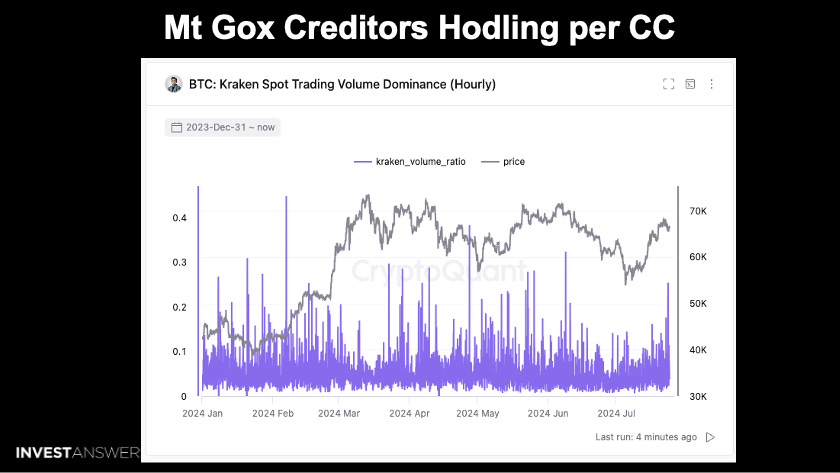

Mt. Gox Creditors are HODLing

Ferrari to Accept Bitcoin

ETH Whales Sold Out Ahead of ETH ETF

Over 60% of NFT Action is on SOL

Tesla Tanks After Earnings

Gold Tanks as China Stops Stacking

Global Liquidity is Rising

This OCTA will be big, with 54 nuggets that share a lot of exciting stuff. There are a couple of surprises out there that I did not even see coming.

Crypto Market Update:

The global crypto market cap is $2.4 trillion;

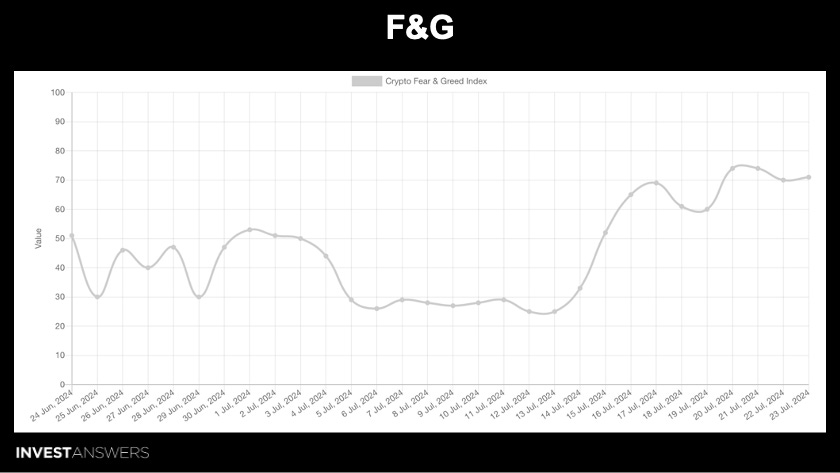

The Crypto Fear & Greed Index is at 69; and

Did the new ETH ETF help save the day?

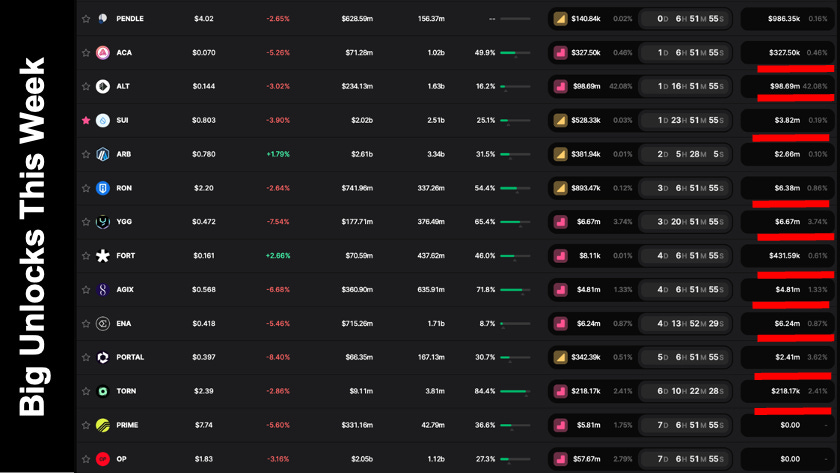

As usual, lots of ugly unlocks. You are not going to make money on these tokens:

ALT is raining down hard.

YGG continues to rain tokens.

ENA is just going to rain from hell.

Very few assets do well. Today, we will also discuss winners and losers.

As I forecasted, the Ethereum Grayscale Trust dump begins today.

Yes, yesterday was a $100 million positive day. The mini trust took in $15 or $16 million today. However, the ETHE Trust dropped nearly half a billion dollars in one day, but they can only do that for 20 days at this rate before it is completely gone.

It should bleed out much faster than the Grayscale Bitcoin Trust.

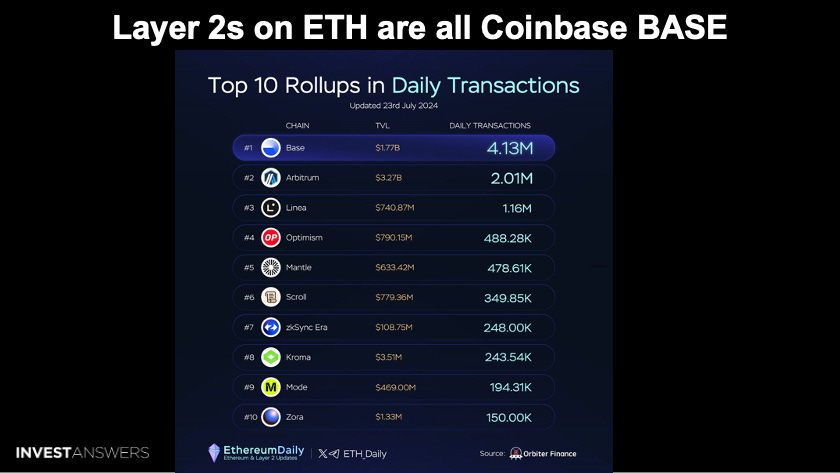

This chart reveals the daily transactions that Layer 2s have on Ethereum. As I say, winners take most, even on the roll-ups.

Perhaps people believe a roll-up is something that you smoke to get high, but that is the only way your bags will rise. These things will not help you get there.

This is why I do not own any Layer 2s.

BASE has become the black hole of the roll-ups and is private. The chain is centralized, with one node run by Coinbase. It is like having a central bank digital currency on Ethereum.

This is a concern for those of you who hate centralization.

Although black holes can be good, they are sometimes not so good.

I thought this was an interesting statistic…

Look at me: I am an investor, and I hold cash. Warren Buffett in Berkshire Hathaway has nearly $200 billion in cash. I call that $200 billion of melting ice cubes. Do you give somebody money to invest to sit on cash? This means either:

They do not know what to invest in; or

They do not dare to bite the bullet and buy something; or

They do not know what to do with the capital.

Let's review the other companies with a stack of cash:

Google = $108 billion

Amazon = $86 billion

Microsoft = $80 billion

Apple = $67 billion; must have spent their cash on something as they had $130 billion last time I checked

There is also $4.1 trillion in cash held by the S&P 500. Imagine for a second if Bitcoin treasuries took off! I will share some news on that front a bit later…

Mark Cuban says that Kamala Harris' camp reached out with multiple questions about crypto.

Probably asking because: We need to know so we can get some votes.

They also wanted to attend the Bitcoin conference, but either the Democrats passed on the event, or the conference organizers said “No, Thank You.” I am not too sure yet.

It will be a banger of a show and good luck to everybody traveling there.

Travel safely and be careful at airports. Airports are places where people lose their minds. My tip on flying is to stay as close to the front of the plane as possible and ignore everybody.

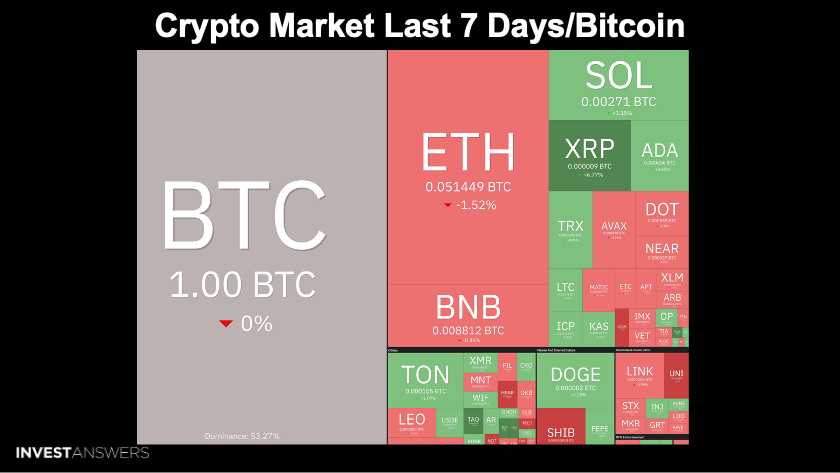

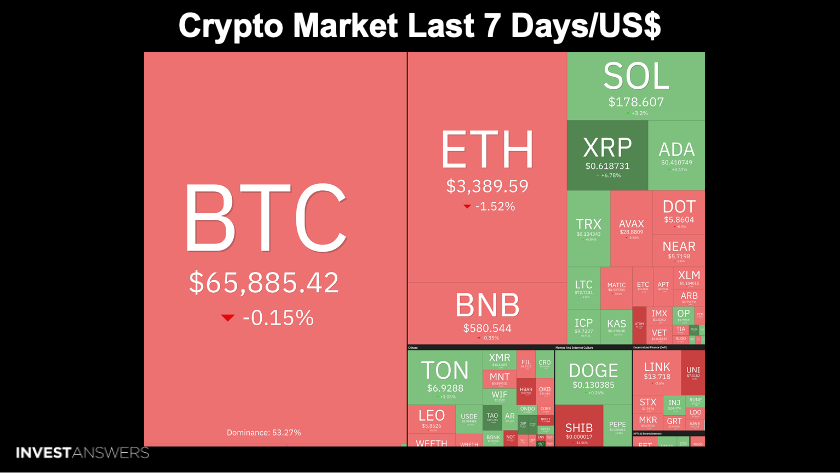

ETH is down 1.5% despite a massive launch yesterday.

SOL, XRP, TRON, TON, and DOGE are up.

The rest is kind of in the red.

Bitcoin is down to flat;

Solana had a good week; and

XRP had a good week.

Overall, it was a mixed bag for the week.

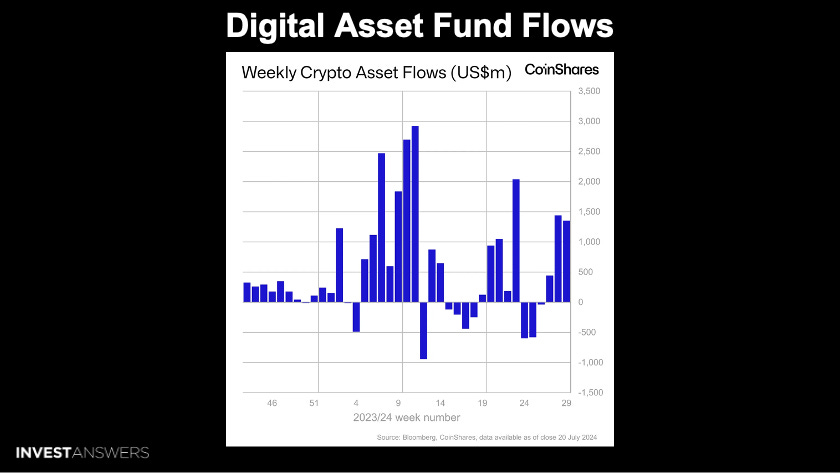

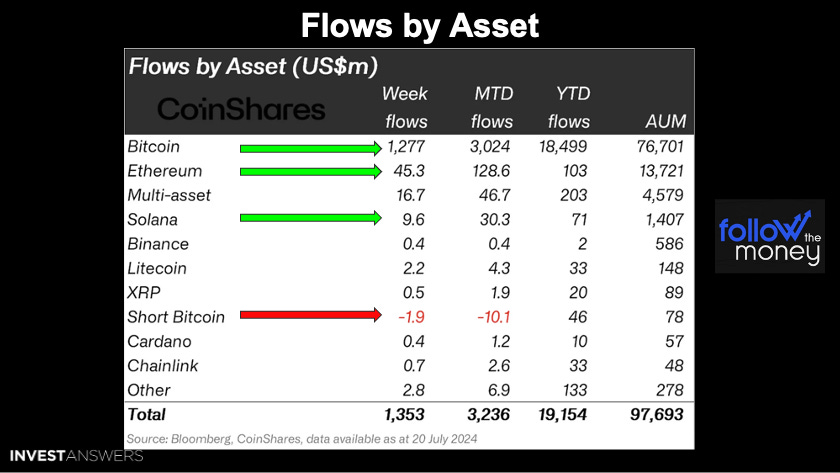

Digital investment asset products saw further buying, with inflows of about $1.35 billion last week. This brings the last three weeks' total to $3.2 billion.

Bitcoin saw $1.27 billion of inflows; and

Short Bitcoin saw an outflow, which is a bullish sign

This table shows the flows by asset:

Bitcoin = $1.3 billion

Ethereum = $45 billion

Solana = $10 million

Short Bitcoin is down

Litecoin = $2.2 million

Overall, a good month for Bitcoin and Ethereum.

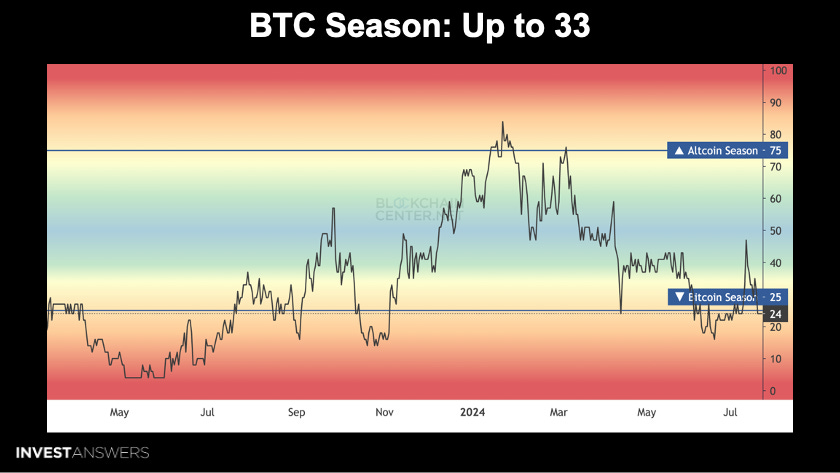

The AltSeason Index is at 24.

We are deep into Bitcoin season, where Bitcoin is outperforming. It is important to look at the breakdown to determine a median value.

The Fear & Greed is at a crazy number...

Right now, it is just under 70.

I did say that O.G.s have been waiting ten years to get their hands on your Bitcoin.

You knew of its value ten years ago, so what is the first thing you will not do?

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.