Perfect Storm Driving Market Upheavel

Last week we felt Govt Shutdown was a nothingburger - this week we have a different set of surprises. Bond Market, CDS Spikes, Debt Spiking, Bonds Selling Off, Political Upheavel n Markets Tanking

First of all - Dow Jones lost all year-to-date gains in a rapid turn for the worst.

On Tuesday, an intensifying bond selloff sparked new losses on Wall Street, killing all ytd gains for the Dow Jones. Yields on U.S. Treasurys to fresh multiyear highs.

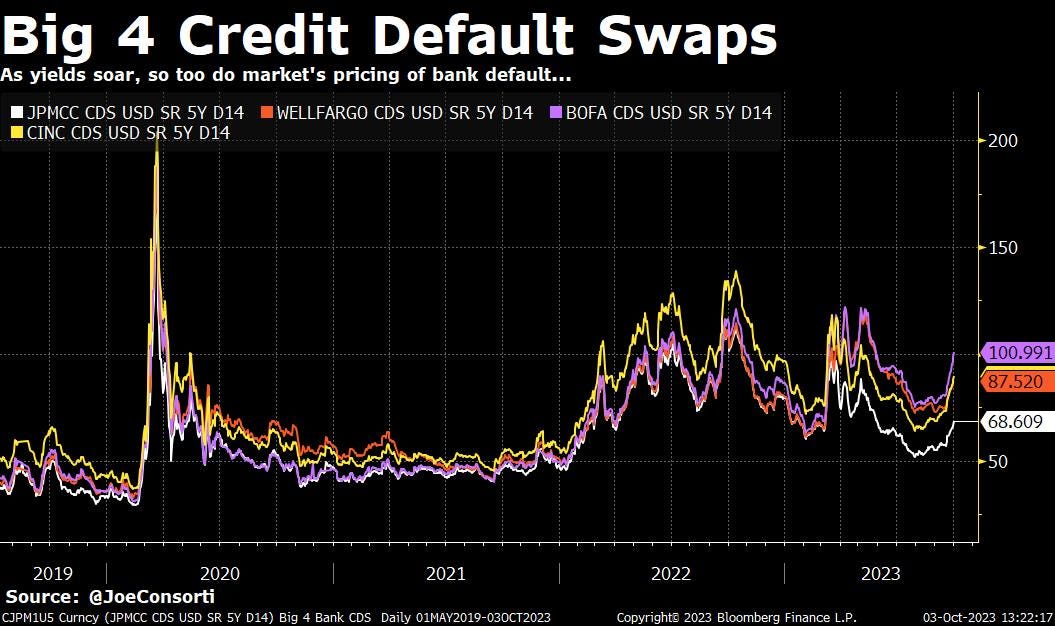

The widening credit default swaps (CDS) spreads for the Big Four US banks suggest that investors are increasingly concerned about the risk of default. The recent sharp decline in 10-year Treasury bond prices has raised worries about devalued collateral leading to margin calls.

CDS markets signal investors believe there is a higher chance of the Big Four US banks defaulting on their debt.

This is a significant development, as these banks are some of the largest and most important financial institutions in the world

There are a number of factors that could be contributing to the widening CDS spreads, including the ongoing war in Ukraine, rising inflation, and the potential for a recession in the United States. Investors are also concerned about the exposure of the Big Four US banks to risky assets, such as corporate loans and emerging market debt.

The widening CDS spreads are a sign that investors are becoming more cautious about the creditworthiness of the Big Four US banks. This could lead to higher borrowing costs for these banks and make it more difficult for them to lend to businesses and consumers.

Not only do we have global market turmoil, and worsening deficits, but there is also some severe turmoil in the bond markets and also the political landscape.

Intensifying Bond Selloff:

A significant bond selloff is underway, leading to a rise in yields. This makes bonds more attractive compared to dividend-paying stocks, driving investors away from the latter.

High Treasury Yields: The yield on the 10-year Treasury note surpassed 4.8%, its highest level since August 2007. Similarly, two-year note yield rose to 5.148% and the 30-year bond payout hit 4.936%. These high yields, comfortably above inflation rates, can negatively impact companies' results and pressure their stock prices.

Impact of Real Interest Rates:

The potential for real interest rates to continue rising poses a threat to equity markets. Companies could suffer due to increasing costs of capital.

Cash Hoarding: With uncertainties in equity and bond markets, many investors are favoring cash. Returns on cash, around 5.5% in money-market funds and short-term Treasury bills, are now seen as relatively attractive, with even notable investors advocating for a "T-Bill and Chill" strategy.

Strong Labor Mkt - Anticipation of Rate Hikes:

To make matters worse, the labor market showed signs of strength. Why is this bad? Well the recent employment data indicates job openings increased significantly, suggesting resilience in the labor market. If upcoming job reports are strong, they could convince investors that further interest rate hikes by the Federal Reserve are imminent to counteract inflation and control the economy.

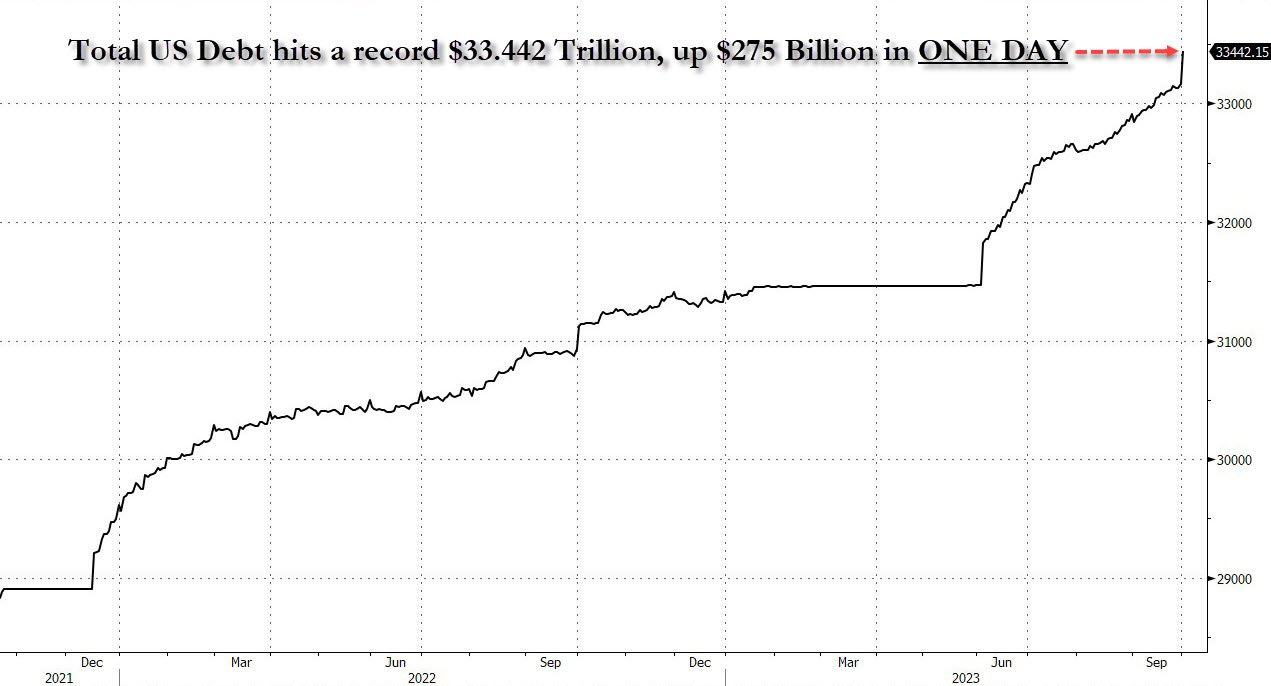

US Debt Continues to Explode

It is so bad I made a video about the Debt Problem Last week

BREAKING: Total US debt rises by $275 billion in ONE DAY to a record $33.44 trillion, according to Zerohedge.

Exactly 2 weeks ago, total US debt hit $33 trillion for the first time ever.

To make matters worse, we also have some political upheaval.

Unprecedented Ouster:

Kevin McCarthy has been removed from his role as House Speaker in an unprecedented mid-term ousting. The government avoided a shutdown but now faces potential instability due to the lack of a clear successor.

Market Reaction: The political turmoil had clear effects on the financial markets. Bonds experienced a selloff, with the 10-year yield climbing to nearly 4.8%. The S&P 500 dropped 1.4%, and the Dow Jones Industrial Average declined by 430.97 points or 1.3%.

F&G

Finally Fear is Extremely Fearful

I still have a pot of cash left over from Sept waiting to deploy - buying during Extreme Fear times often works but will wait for some dust to settle

Have a nice evening

james