TLDR

Raising capital gains hurts capital markets

the US Govt adds 1.2 Trillion in Debt every 100 days and that is accelerating.

President Biden’s proposal to increase the top individual ordinary income tax is projected to raise $245.9 billion over 10 years. I REPEAT THEY SPEND 1.2 TRILLION EVERY 100 Days.

Those who pay taxes will leave the USA.

I am beyond mad at this idiocracy!

The Government's Flawed Wealth Tax Agenda

The Biden administration's proposed tax hikes on capital gains and high-income earners have stirred up quite the controversy. As someone deeply concerned about sustainable economic policies, I feel compelled to weigh in on what I believe is a fundamentally flawed approach that could severely undermine America's standing as a hub for investment and innovation.

The Key Points:

Raising capital gains taxes hurts capital markets by discouraging long-term investment and risk-taking. This is extremely counterproductive for an economy striving to remain globally competitive.

The US government is racking up debt at an unsustainable pace - over $1.2 trillion every 100 days. Raising taxes on the wealthy and investment income is a mere drop in the bucket compared to these runaway spending levels.

Biden's tax plan aims to raise $245.9 billion over 10 years from higher ordinary income taxes on top earners. Let that sink in - ten years - they spend over 5x that amount every 100 days through deficit spending!

Ultimately, the ones who will get burned by these punitive tax policies are the very investors, entrepreneurs and skilled workers that drive America's economic dynamism. They have the means to vote with their feet and take their capital elsewhere.

But don't trust me - Trust Arthur Laffer

I'm utterly exasperated at this display of economic illiteracy from policymakers. Don't take my word for it though, let's hear from the renowned Arthur Laffer himself...

Source: Center to Unleash Prosperity/Laffer Associates

This is sheer idiocy, as Laffer collaborator Stephen Moore rightly puts it. Rather than penalizing the drivers of growth and prosperity, our leaders should pursue policies that incentivize productive investment and work. The path to a thriving, competitive America lies in limiting debt, reining in wasteful spending, and fostering an investor-friendly climate - not counterproductive wealth taxes that will ultimately diminish national prosperity.

We deserve better stewardship of our nation's finances and long-term economic wellbeing. Until we see meaningful course correction, the outlook for sustainable wealth creation remains deeply concerning.

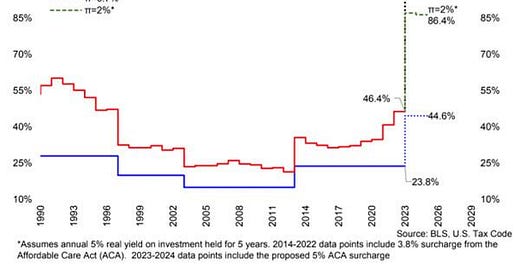

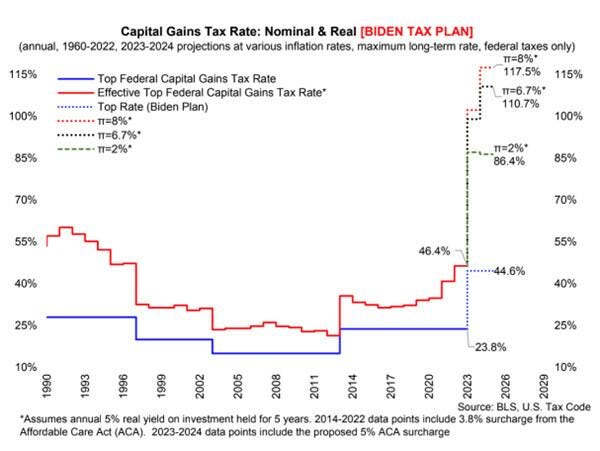

President Joe Biden's proposed increase in capital gains tax could effectively charge investors more than 100% tax after considering inflation. According to Arthur Laffer, a former advisor to Ronald Reagan, the proposal could more than double the current tax rate for long-term investments for those earning over $1 million.

Biden’s plan, part of his $6.8 trillion budget for 2024, would raise the capital gains tax rate from 20% to 39.6% and add a 5% Affordable Care Act surcharge, totaling a 44.6% tax rate for high earners. Economist Stephen Moore suggests that with expected inflation rates, the real tax rate could soar to 86% or even exceed 110%.

Moore illustrates the issue with an example: If you buy stock at $100 and it rises to $120 in five years, but inflation was 24%, you actually lose money after inflation. Yet, you’d still owe the government 40% tax on the $20 increase, which he calls "sheer idiocy.