DCA Live - Alpha Summary

Crypto Market Insights: A Comprehensive Analysis from IA, Mando, CTO and Marty

I think this was one of the best DCA’s ever - hence I am summarizing it in this note. And yeah we will buy Marty a new Mic :D

Yearly Breakdown and Analysis

In the video interview, we provided a detailed breakdown of the crypto market's performance over the past year. Net net it is a tricky period - 90 days post halving, FUD, headwinds, MtGox, Germany etc

Potential Bull Run in October

Give the seasonality - we all expect a nice run to really kick off in about ten weeks - but also potential for it to happen sooner.

Market Maker Shenanigans

The panelists unanimously agreed that the fourth quarter of the year could be exceptionally dynamic, with numerous catalysts potentially driving a bull run in October. Among these catalysts is BlackRock's Bitcoin ETF, which has shown suspicious trading patterns, including $1 billion in daily volume without significant additions or deletions. The experts suggested that ETF providers might be engaging in carry trading and shorting futures, which could significantly impact the market.

Is BTC Undervalued Now?

The discussion also touched on whether Bitcoin (BTC) is currently undervalued. The German government's sale of over half their BTC in a very short window of time was cited as a factor contributing to the recent price decrease. Market makers are believed to be manipulating the market, leveraging news events like the German sale to their advantage. Despite these manipulations, various metrics indicate that the current Bitcoin price is at "fair value."

But the takeaway was we are definitely in the value zone.

German Government and Bitcoin Saga

The panel explored the implications of the German government's remaining BTC holdings and how future sales might affect the market. This ongoing saga continues to be a point of interest for investors and analysts alike. However, Mando said - once they are half done, which is where we are now - things will kick off.

Election Year Performance and Crypto User Growth Trends

The historical performance of the S&P 500 during election years was analyzed, providing insights into potential market behavior. Additionally, the discussion highlighted trends in crypto user growth, emphasizing the increasing adoption and interest in cryptocurrencies.

80/20 Portfolio Allocation Strategy

An interesting point was raised about the 80/20 portfolio allocation strategy.

I always maintained an 80% HODL Bag and a 20% trading bag. Marty shared his positions, with 40% in BTC and 40% in SOL, and the remaining 20% for speculative trades. He likes Perps on BTC etc. This strategy mirrors my 80% HODL and 20% trading approach, underscoring its popularity among investors.

ETH & SOL Mispricing

A significant topic was the $300 billion mispricing between Ethereum (ETH) and Solana (SOL). The panelists agreed on the stunning deltas in metrics and stressed the importance of following developers, money, and adoption trends in the crypto space.

We agreed SOL is undervalued compared to ETH trading at only 17% of the market cap while doing many multiples more.

Matic Founder Moving On

The departure of the Matic founder and the intersection of artificial intelligence and crypto were discussed. The panelists noted the growing narrative around AI and its potential impact on the crypto industry.

Note my entire focus is only two narratives and they are crypto and artificial intelligence. So I am very happy to see the collision course between these two narratives.

Polkadot Influencer Marketing

Mando shared insights on Polkadot's (DOT) influencer marketing strategy, revealing that many chains use influencers to promote their projects. This revelation sparked a discussion on the ethics and effectiveness of such marketing tactics. I was shocked.

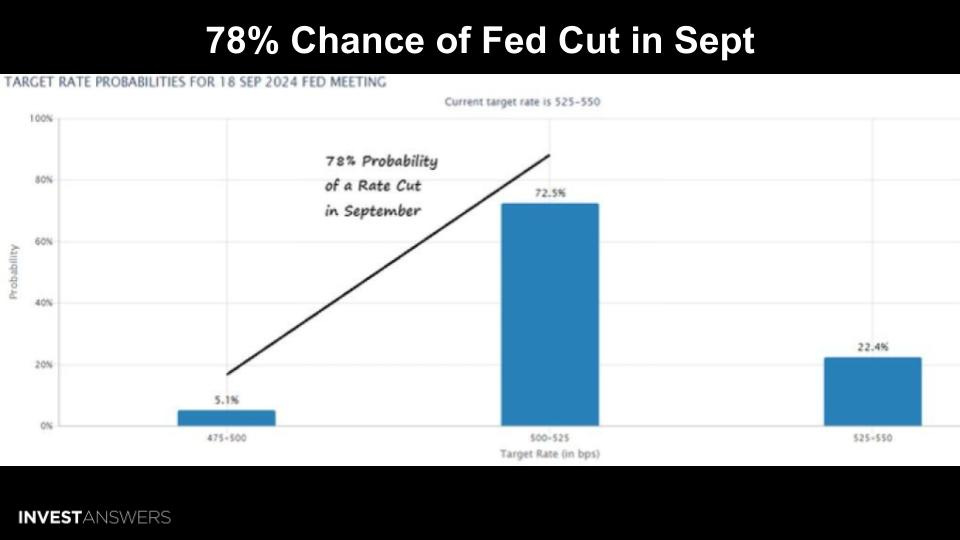

Federal Reserve Rate Cut Predictions

The panelists predicted a 78% chance of a Federal Reserve rate cut in September, which they believe will significantly impact the market. This prediction aligns with the Sahm Rule indicator, suggesting that the USA might be heading into a recession.

Data Privacy Concerns

Marty raised concerns about data privacy, emphasizing that Web 2.0 companies often sell user data. He warned of potential security breaches and nondisclosures, urging users to be cautious about their data.

High Tax Rates in France

The discussion concluded with a shocking revelation about a potential 90% tax rate proposal in France. This news surprised the team, highlighting the varying tax policies across different countries and their potential impact on investors.

CTO said rookie numbers :D - Mentioned historical Swedish tax rates reaching up to 103%

Key Takeaways From Each Individual

James:

* I moderated the discussion and presented various topics and data points

* Highlighted the $300 billion mispricing between Ethereum and Solana

* Discussed the importance of following developers, money, and adoption in crypto

* Emphasized the 80/20 portfolio allocation strategy (80% hodl, 20% speculation)

* Pointed out the recent surge in token unlocks, totaling about $1 billion over 30 days

* Brought up the 78% chance of a Fed rate cut in September

* Mentioned the potential 90% tax rate proposal in France

CTO:

* Focused on technical analysis and chart patterns

* Emphasized the importance of analyzing crypto prices against Bitcoin rather than USD

* Highlighted the breakdown in US government bond yields as a positive sign for speculative assets

* Discussed the value of listening to different perspectives and models when analyzing the market

* Stressed the importance of reacting to actual market movements rather than predictions

* Mentioned historical Swedish tax rates reaching up to 103%

Mando:

* Provided insights on market dynamics and adoption trends

* Discussed the frustration in the crypto market despite positive macro indicators

* Highlighted Solana's performance metrics compared to Ethereum

* Shared information about influencer marketing in crypto and its prevalence

* Discussed the pivot of some crypto founders to AI projects

* Emphasized the potential for significant stablecoin market growth - agreed w Marty it could hit $30T

* Pointed out the leftward political shift in some European countries and its potential impact

Marty:

* Offered a technologist's perspective on crypto markets

* Discussed the concept of "Wyckoff" accumulation phases in Bitcoin's price action

* Emphasized the role of market makers in manipulating prices - this was expected but still eye opening to hear how strongly he emphasized it

* Highlighted concerns about Layer 2 solutions and their potential risks - agrees with me on this one

* Predicted significant growth in the stablecoin market, potentially reaching $30 trillion

* Discussed the potential for a "squeeze" in Bitcoin's price due to high short-interest

* Emphasized the importance of permissionless systems in crypto

* Warned against WEB2 companies like MSFT GOOG selling your data.

The comprehensive analysis provides valuable insights into the current state of the crypto market and offers predictions for the future. Investors should consider these varying factors and points of view from different people when making informed decisions in the ever-evolving crypto landscape.