Bitcoin's Fate in a FIAT System Collapse: A Forecast from 🇯🇵

Bitcoiners, we have a new CANARY IN THE MINE!

Bitcoin's Fate in a FIAT System Collapse: A Forecast from Japan

As Fiat Collapses - everyone runs for the Life Raft, in Japan this is now a stock!

The Japanese bond market teeters on the edge of collapse, a canary in the coal mine of global fiat systems.

With Japan's debt-to-GDP ratio at a staggering 260%, rising bond yields, and a weakening yen, the cracks are widening. Prime Minister Shigeru Ishiba has warned the fiscal situation is "worse than Greece’s," signaling a potential debt spiral.

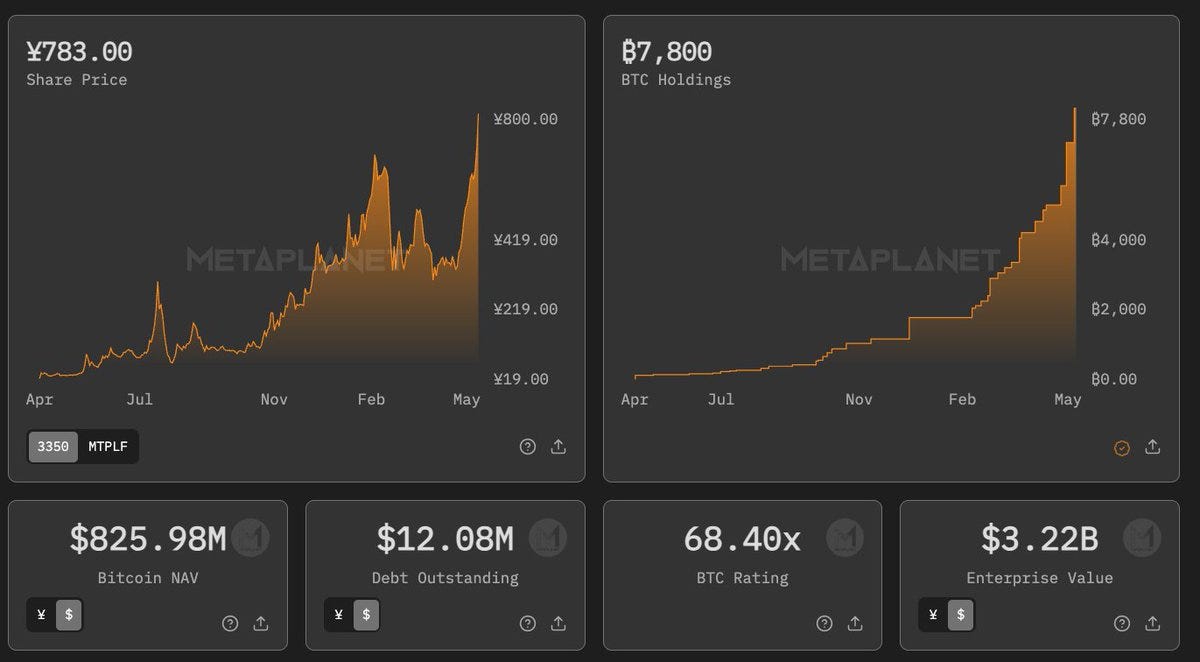

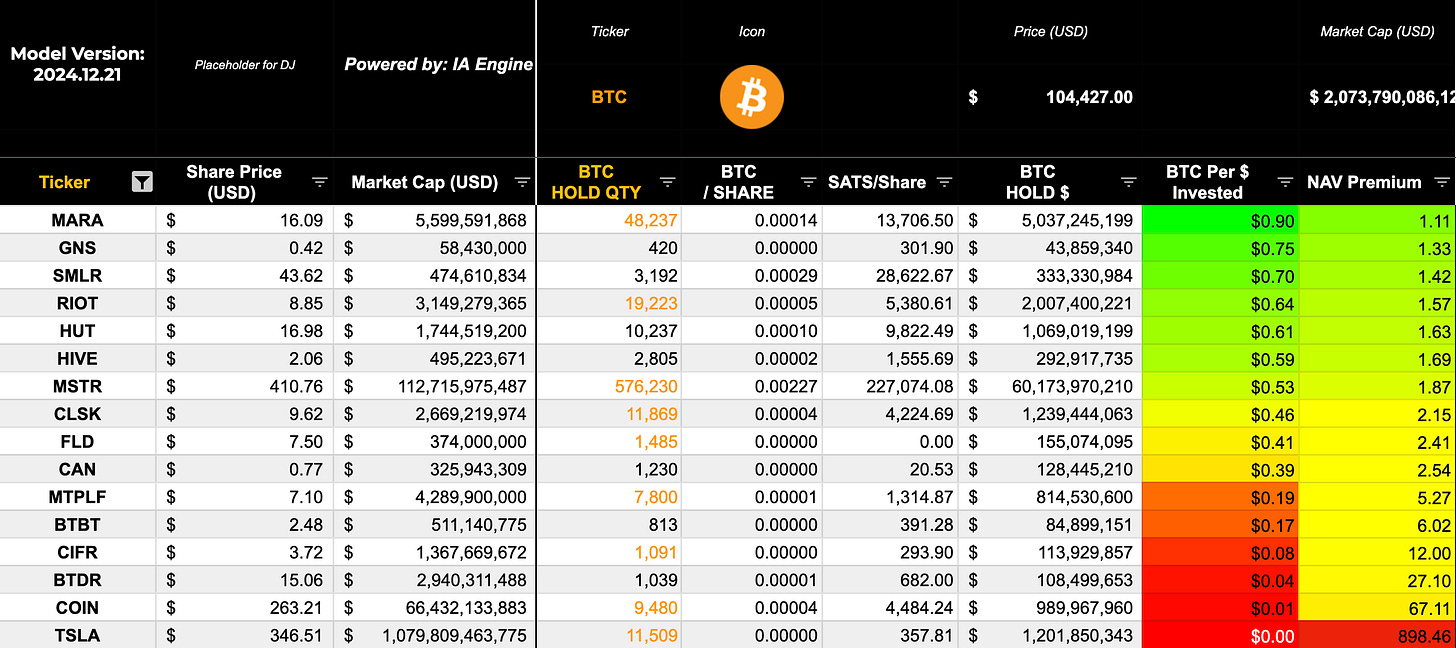

Enter Metaplanet, Japan's answer to MicroStrategy (MSTR). This Tokyo-listed firm is aggressively accumulating Bitcoin, holding 7,800 BTC worth over $800 million, funded by zero-coupon bond sales. Its stock is surging, up 33% in 2025, mirroring Bitcoin’s rally near all-time highs. Metaplanet’s strategy—modeled on Michael Saylor’s playbook—positions it as a hedge against fiat devaluation, with plans to reach 10,000 BTC by year-end.

h/t Dylan LeClair - Metaplanet's 210 Million 0% discount moving strike warrant plan has been completed, raising ~$645m in approximately three months. Metaplanet now holds $825.98m of BTC against $12.08m of outstanding bonds.

NAV prem is high however - but that is the price you gotta pay

As Japan’s financial system falters, global confidence in fiat weakens. Bitcoin, engineered for such crises, stands to soar as capital flees to decentralized stores of value.

If Japan’s bond market implodes, expect BTC to break $120,000, redefining wealth preservation in a post-fiat world.

Check out the Metaplanet Stock Price Today as a reminder once more!

The canary is singing. Are you listening?